SATS (SGX: S58) just released its FY2024 earnings and investors are super excited, pushing its share price up by over 6% within the day itself. 6% might seem like a small move to some but for a stock listed in the Singapore market, which is a relatively small and stable exchange, a 6% move is rather drastic. So what caused this to happen? Let’s take a deep dive into the FY2024 earnings of SATS and see if it’s a good investment now.

FY2024 Earnings

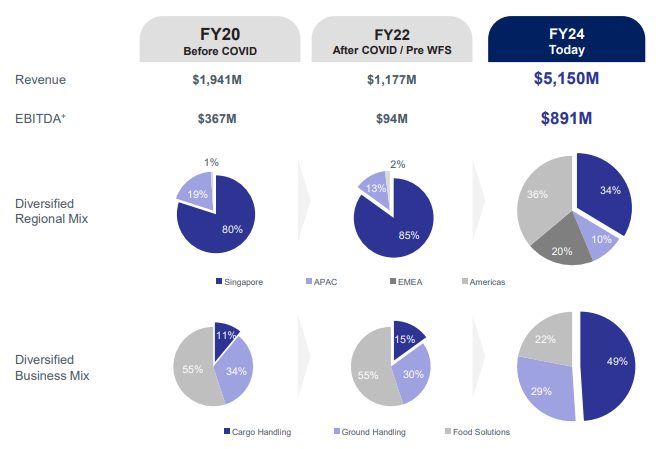

SATS saw drastic changes to its business, and overall financials over the past 5 years, going through the hardships of the COVID-19 pandemic. Despite this, the company has managed to grow its revenue substantially, past its highs in FY2020 by over 165%. SATS has also managed to achieve net positive Profit attributable to owners of the Company (PATMI) in FY2024, bouncing back from being loss-making in FY2023. SATS also grew its operating cash flow by over 6.4x from FY2023 to $512.1m. On top of this, SATS saw a huge improvement in its Free Cash Flow (FCF), achieving a net positive FCF (before lease payments) of $326.5m.

A key factor to all this growth is due to its acquisition of WFS which was completed in April 2023. In FY2024, WFS contributed revenues of $2.91B (56.5% of revenue) and operating profit of $187.2m. Diving into the specifics, SATS Group (including WFS) saw huge growth coming from 2 key areas of business, namely Flights and Air Cargo, which grew by 162% and 429% respectively in comparison to pre-COVID levels.

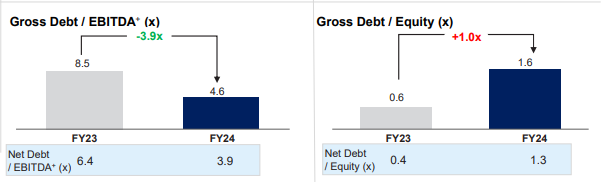

Looking at the balance sheet of SATS, we can see that its Gross Debt to EBITDA ratio has improved substantially year over year, from 8.5x to 4.6x. Its Net Debt to EBITDA ratio has also improved from 6.4x to 3.9x. On the other hand, its Gross Debt to Equity ratio (DER) has risen substantially from 0.6x to 1.6x. Its Net Debt to Equity ratio has also increased from 0.4x to 1.3x.

The huge increase in the overall DER is quite troubling as this means that the company is rather leveraged financially. Although the average DER differs across industries, for a company like SATS which has business in both Aviation Services as well as Catering and Food Services, we will need to take the industry average for both business segments and make an estimate from there.

For companies that offer Aviation Services, the average DER ranges between 1x to 3x, whereas for companies that offer Catering and Food Services, the average DER ranges between 0.5x to 2x. As such, a good average estimate for SATS would be a range between 1x to 2.5x. Given both its Gross and Net DERs are within this range, it is safe to assume that SATS isn’t over-leveraged at this point. Despite this, as investors, it would be preferred if SATS was less leveraged as the cost of debt is rather high right now.

Potential Growth Catalyst

Management’s Value Creation Plan

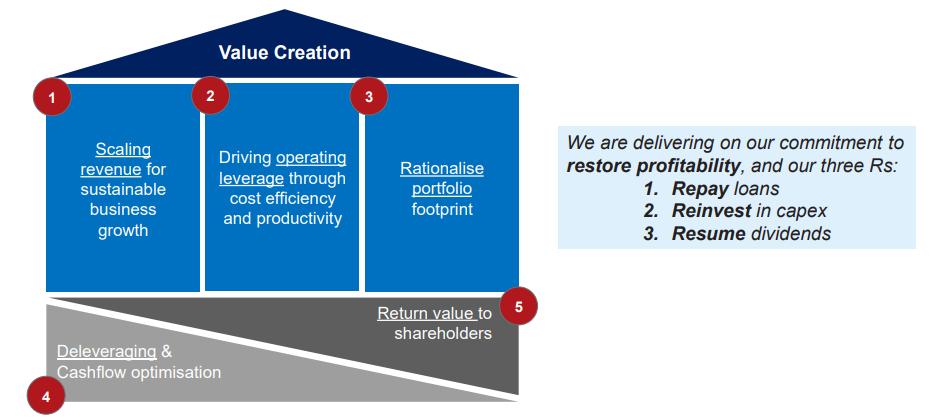

In the FY2024 earnings release, SATS’s management has guided a value creation plan for shareholders. To summarize, the management team aims to scale the company’s revenue to ensure its business growth is sustainable. It will also efficiently and effectively utilize its operating leverage. The end goal is to ultimately deleverage and optimize its cash flow, which will return value to shareholders. In short, the management has committed to restoring profitability, reducing debt, reinvesting in capex, and resuming dividend payouts for shareholders.

To further elaborate on the plan, SATS aims to achieve 3 key targets for FY2025. Firstly, they would like to repay $200m of its borrowings. Secondly, reinvest $300m of its capex. Last but not least, resume a dividend payout of 1.5 cents per share.

Bullish Outlook

Global air passenger traffic is projected to recover fully to 2019 levels by the end of 2024, while global air cargo traffic is forecasted to grow by 4.5% in 2024. SATS will benefit greatly from these key trends after restructuring its business segments.

As seen from the image above, SATS has repositioned its business segments to be more diversified, with the majority of its revenue (49%) coming from Cargo Handling in FY2024, as compared to Food Solutions in FY2020 (before COVID) and FY2022 (after COVID), which accounted for 55% of its total revenue. On top of this, SATS has also expanded geographically, from having Singapore as its key market accounting for 80% of its revenue, to America being its key market now accounting for 36% of its revenue.

Final Thoughts

Overall, SATS saw a phenomenal set of results in FY2024, bouncing back into profitability after a rough FY2023. We can also see that SATS’s acquisition of WFS is starting to bear fruits, as it contributed to over 50% of SATS’s overall revenue in FY2024. With so many key growth catalysts, SATS is definitely set to grow over the long term.

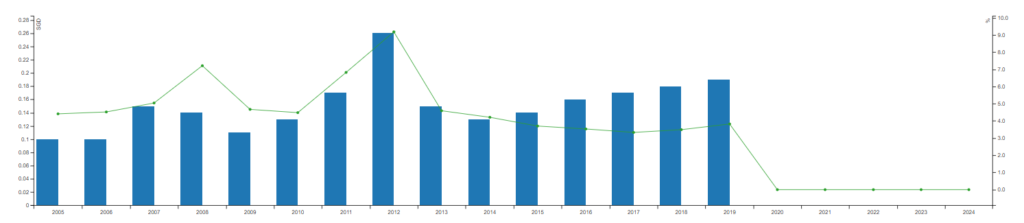

Additionally, dividend investors can start rejoicing as SATS will restart its dividend policy after pausing it for 4 years. As we can see from the chart above, SATS was a rather consistent dividend growth stock, growing its dividend payout consistently from 2014 to 2019, right before the COVID-19 pandemic hit. It is important to note that the dividend policy back then had a payout ratio of 70% to 80%. The management has guided that because SATS is currently in its “growth phase”, the old policy could not be re-implemented.

Based on its declared dividends of 1.5 cents and a last closing price of $2.79, SATS has a forward TTM yield of 0.53% which is rather low, but it might be good to view SATS as a growth company now rather than a dividend payer like it was in the past. This might be a good time for investors to start taking notice of SATS and perhaps even initiate a small position. Perhaps in the future, we might see SATS adopting its old dividend policy again when it has reached a more stable phase in its growth cycle.