Many advanced strategies can be used to profit off any market cycle in the world of options. For investors looking for an options strategy that can provide consistent cash flow, look at the Wheel Strategy. This strategy is simple to understand and can amass great wealth and provide a strong consistent stream of cash flow throughout any market cycle. Without further delay, let’s jump right into the Wheel Strategy and how to implement it effectively in 2021.

Step 1: Stock Selection

The first step to the wheel strategy is to pick a basket of stocks, around 5-10 which you are comfortable trading and holding. There is no fixed guideline on what to choose but it is ideal for you to pick stocks that you are comfortable holding for a long period of time.

This is my own personal criteria which you can refer to:

- Comfortable with holding this stock for > 2 years

- Predictable and bullish price movement over the long term

- Share price between $10-$50 so that I can afford to take the assignment if needed

- (Optional) Pays a nice dividend so that I can receive an additional stream of income should I stay assigned for a long period of time

It is important that you are able to pick out a small basket of stocks that fulfil your personal criteria because there might be instances whereby certain stocks won’t be able to perform the Wheel Strategy due to a high risk but low reward trade or that it is too expensive to execute.

Step 2: Sell Cash Secured Puts (CSPs)

After you have selected the stock you are planning to perform the Wheel Strategy with, you are going to start off with selling a CSP. Selling a cash-secured put is similar to selling a regular, also known as a naked put, but the key difference is that you have sufficient capital to buy over the shares at the chosen strike price should the option become assigned.

Read More: Understanding 2 Important Options Strategies For Beginners (Sell Cash-Secured Puts)

Choosing the right strike price as well as the expiry date is crucial to the success of the Wheel Strategy. As such, here are my personal criteria for choosing which specific option to sell CSPs on.

- 30-45 Days to Expiry (DTE) as it offers a good premium as time decay states to accelerate

- >70% probability to expire Out of the Money (OTM), which is also <0.3 Delta

- The number of contracts is dependent on how many shares the account can handle being assigned

- Close when profits > 50% 15 days before expiry, else hold until expiry

- (Optional) Roll for Credit if possible

The question on when to close for profits is debatable as some traders would say to never close and always hold until expiry. This could be risky because you are running the risk that the share price might move against you and your profits could be wiped right before expiry. To avoid this from happening, you can choose to close the position early and then reopen another one.

The CSPs should be able, to be sold over and over to collect as much premium as possible, and often never be assigned. If there is a fundamental change in the stock, close your position for an overall net profit and move onto the next stock in your basket. On the off chance that you do get assigned, you can move onto Step 3.

Step 3: If CSPs Assigned, Sell Covered Calls (CCs)

If your CSPs did not get assigned and simply expired, you can go back to Step 1 and repeat the whole process. Steps 3 and 4 are for when you do get assigned.

If you are at this step, this means that you were assigned your shares. You will now proceed to sell Covered Calls. A covered call is when an investor is selling call options while owning an equivalent amount of the underlying security. To execute this, an investor holding a long position in a stock then writes (sells) call options on that same asset to generate an income stream through the premiums collected. The investor’s long position in the stock is the “cover” because it means the seller can deliver the shares if the buyer of the call option chooses to exercise.

Read More: Understanding 2 Important Options Strategies For Beginners (Sell Covered Calls)

:max_bytes(150000):strip_icc():format(webp)/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Similar to step 2, choosing the right strike price and expiry date is important to whether or not you will do well when applying the Wheel Strategy. Before I move into my personal criteria for which option to sell covered calls on, it is important for you to track your average cost for your outstanding shares. Remember that when you are assigned, your cost price is not just the strike price but rather, the strike price – the premium collected from selling the CSPs.

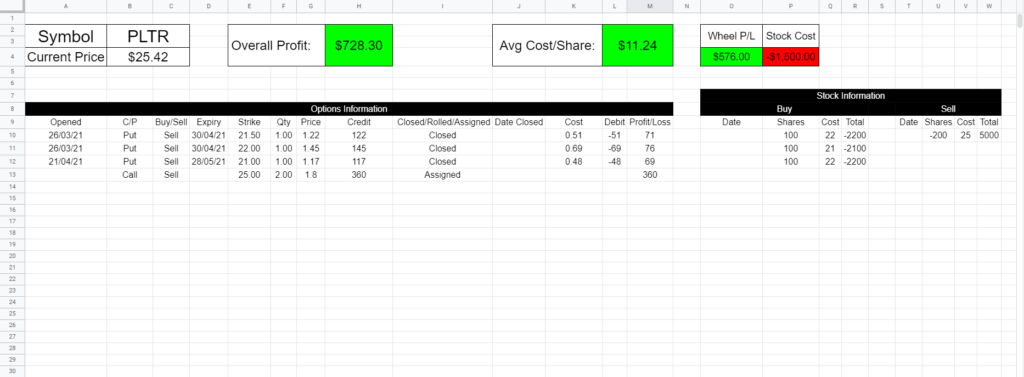

I have shared a free-to-use Wheel Strategy P&L Tracker in which you can input all your transactions. Feel free to make a copy for your own usage. Once you have input the transactions, it will show you important metrics such as Overall Profit and Average cost per share.

Once you have gotten your average cost per share, we can start with step 3. Here are my personal criteria when choosing which options to sell covered calls on:

- The chosen strike price should always be above your cost price

- 30-45 Days to Expiry (DTE) as it offers a good premium as time decay states to accelerate

- >70% probability to expire Out of the Money (OTM), which is also <0.3 Delta

- The number of contracts is dependent on how many shares you have

- Close when profits > 50% 15 days before expiry, else hold until expiry

- (Optional) Roll for Credit if possible

The first criteria could be hard to achieve at times because you might only get a small premium if you choose an option with a strike price above your cost. In this instance, you have 2 options.

Firstly, you can choose to hold onto your shares. If your average cost is above the current market price, then the goal is to keep on selling CCs and collect the premium. This will ultimately lower the average cost further below where the stock is trading before it gets called away.

If not, you can always sell options with strike prices below your average cost but still offer a good premium. Although this is not recommended because you might incur a loss, some traders and investors would prefer not to have any capital “stuck” and would rather take a small loss and repeat the system again.

Step 4: If CCs Assigned, Repeat Step #1

Last but not least, the 4th step in the Wheel Strategy is that if and when your CCs do get assigned, you collect your net profits/losses, tally your spreadsheet and review your trades.

Understand what went right and what went wrong as well as areas that could be improved such as taking profits earlier/later due to external factors such as earnings reports or news/announcements made by the company.

Once that is done, you can rinse and repeat the entire system, thus improving your own trading strategies as you trade and learn more.

Who Should Use This Strategy?

The Wheel Strategy is also known as the Triple Income strategy because you receive 3 streams of income during the entire process of the strategy. When you sell CSPs, CCs, and ultimately when your CC gets assigned. Furthermore, if you were to apply this strategy with dividend-paying companies, you will receive an additional 4th stream of income which is the dividends.

As such, this strategy is better suited for investors and traders who are looking for an options strategy that can provide them with consistent cash flow almost every week. This strategy is also used by long-term investors that want to accumulate on a specific stock for the long term while lowering their cost basis.

Potential Risks

The biggest risk with the strategy is that if the stock price drops significantly in a short period of time, there is a high likelihood of you being assigned the shares. Of course, your risk is definitely lowered because you still receive a premium when selling CSPs, thus lowering your overall average cost per share.

Furthermore, if you choose the right stock that you are comfortable with holding for the long term, there is nothing to worry about if you do get assigned during the process.

Another risk would be that if the stock price rises up significantly, you will miss out on a lot of gains as compared to if you just bought the shares directly. As mentioned above, this strategy is mainly for consistent cash flow. As such, catching onto huge capital gains is not the main purpose of this strategy and you are better off with simply buying a call as compared to using this strategy.

Final Thoughts

All in all, the Wheel Strategy is a fantastic options strategy for investors who want to accumulate a specific stock for the long-term while generating a consistent stream of income which can be used to lower the average cost per share. Although the strategy does sound perfect in theory, there are definitely some setbacks such as being assigned shares for a long period of time, keeping your capital “stuck”. Therefore, investors must understand when to apply this strategy to avoid making any huge losses and maximize their profits.

Greetings, can you elaborate the point :(Optional) Roll for Credit if possible for Step 2 and 3? What are the considerations and criteria to roll ? Thank you very much

Considerations, when you are rolling the option, would be DTE, intrinsic and extrinsic value as well as the current delta. For myself, I roll on green days, 30-45 days out. I will roll earlier if my option is a little too deep in the money.

Hi,

thanks for the great tips on how to generate regular income with Wheel Strategy.

When you mention “Close position” on CSP, do you mean use the buy function or the Close function in the brokerage app? I am using IBKR for example.

Cheers,

Anthony

Hey Anthony,

that is correct! So when we say close the position, we mean to buy back the options that we have sold.