NVIDIA Corporation (NASDAQ: NVDA) has been a leading player in the semiconductor industry, particularly known for its graphics processing units (GPUs) used in gaming, data centers, artificial intelligence (AI), and autonomous vehicles. Looking at its significant growth in share price of almost 100% year-to-date (YTD) and over 250% over the past 12 months, could there still be reasons why an investor should consider investing in NVIDIA in 2024? In this article, we will deep dive into several factors that an investor should consider before investing in NVIDIA.

Company Overview

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA has emerged as a dominant player in the semiconductor industry, particularly in the gaming, data center, automotive, and professional visualization sectors. Its core business is surrounded by its GPUs which have multiple use cases as mentioned above. Thanks to the recent uproar in interest towards Artificial Intelligence and Machine Learning, NVIDIA has seen its stock skyrocket exponentially since late 2022.

Another interesting note about NVIDIA is that Nancy Pelosi, an American Democratic Politician and congresswoman, made big profits from her recent investment in NVIDIA. Shortly after her trade was filed and published, NVIDIA’s stock saw a drastic uptick in popularity. Of course, as investors, we know that this is pure speculation and that this, might or might not be related but, it’s not uncommon to see politicians influencing the stock market, whether they do it intentionally or not. There are several threads across the internet, tracking the buys and sells made by politicians, so that investors can discuss and follow.

FY2024 Earnings

As we’ve seen across the internet and news articles, 2023 or FY2024 was a stellar year for NVIDIA. Let’s take a closer look into what went so well for them and whether or not they can replicate the same level of success into FY2025.

As we can see from the FY2024 earnings shown above, NVIDIA has consistently grown its revenue quarter over quarter for the entirety of FY2024. In FY2024 (GAAP basis), NVIDIA grew its total revenue by 126% to US$60.92B as well as its gross margin by 15.8 pts to 72.7%. With only a small increase of 2% in its operating expenses, NVIDIA clocked in an outstanding 681% growth in operating income to US$32.97B, as well as growing its net income by 581% to US$29.76B. This marks a diluted earnings per share (EPS) of $11.93, a 586% increase year over year, bringing NVIDIA’s current PE ratio to ~79.6x,

So what helped NVIDIA skyrocket its revenue? As we dug deeper, we found that the Data Centre segment of its revenue grew by 216.73% year over year, the Gaming segment grew by 15.22% year over year, the Professional Visualization segment grew by 0.58% year over year and its Automotive segment fell by 20.82% year over year. To put it into perspective, 95.79% of the revenue growth in FY2024 came from the Data Centre segment, 4.07% came from the Gaming segment, 0.03% came from the professional visualization segment and 0.55% came from the automotive segment.

Note: If you add up the percentages, you’ll end up with 100.44% instead of 100%. This is likely due to other income streams that were not accounted for as well as a possible rounding error from the numbers obtained from NVIDIA’s earnings release

FY2025 Forecasts

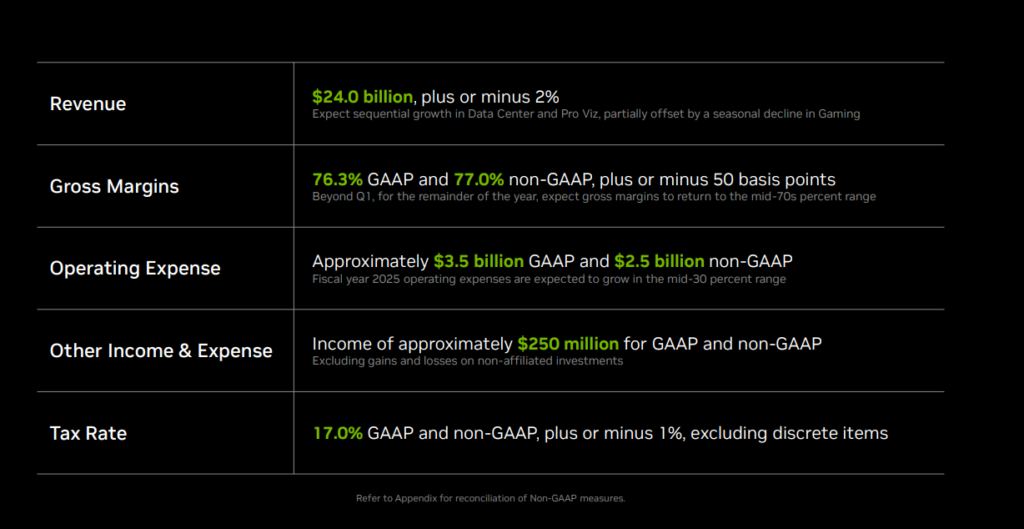

NVIDIA only provided an outlook for Q1 FY2025, which was rather bullish, to say the least. Revenue guidance between US$23.52B to US$24.48B, which marks a quarter-on-quarter increase of 6.41% to 10.75% or a year over year increase of 227% to 240%. They also forecasted gross margins to improve slightly quarter-on-quarter. Provided that NVIDIA can continue this rate of growth, we can expect another stellar year in FY2025.

Potential Growth Catalysts

Looking at the very bullish Q1 FY2025 forecast, NVIDIA must be expecting some growth catalysts to come their way during the year. Let’s dig into a few possible areas of growth that could spur NVIDIA to greater heights.

Increased Trend Towards AI and ML

Large Language Models (LLMs) have revolutionized the field of natural language processing (NLP), allowing for new advancements in text generation and understanding. LLMs can learn from big data, understand its context and entities, and answer user queries. An LLM like GPT-4 consists of over 100T parameters amounting to approximately 400TB of model data. To put it into perspective, OpenAI requires ~3,617 HGX A100 servers (28,936 GPUs) to serve Chat GPT.

Another up-and-coming trend in this space apart from LLMs is Generative AI (GenAI). It’s a type of AI that can create a wide variety of data such as images, videos, audio as well as 3D models. This is another area that NVIDIA has expanded into and will likely gain traction over time. As such, maintaining dominance over the space, and continuously improving its chips will allow NVIDIA to continue growing and not lose its competitive advantage against competitors such as AMD.

Further Expansion in Tesla

It was discussed and tweeted by Elon Musk earlier this year that Tesla (NASDAQ: TSLA) is ready to spend over US$500M on NVIDIA hardware to build the Dojo Supercomputer. Given the scope and complexity of the Dojo Supercomputer, it is not surprising to hear this and we could expect to see even more spending to be made this year alone. Although this wouldn’t make a dent in NVIDIA’s annual revenue, it could definitely make an impact over time if Tesla continues to buy more NVIDIA chips.

In the tweet, Elon mentioned that to stay competitive in the AI space, you will need to spend at least several billion dollars per year. Not forgetting the important fact that having Elon Musk and Tesla being your “spokesperson” is something that money can’t buy and will surely bring in more business over time.

Valuation

Last but not least, valuation. It’s important to evaluate the company realistically based on its historical performance as well as potential growth catalysts in the future. Given that NVIDIA is a rather mature company, it might be appropriate to use a discounted cash flow (DCF) model to evaluate the fair value.

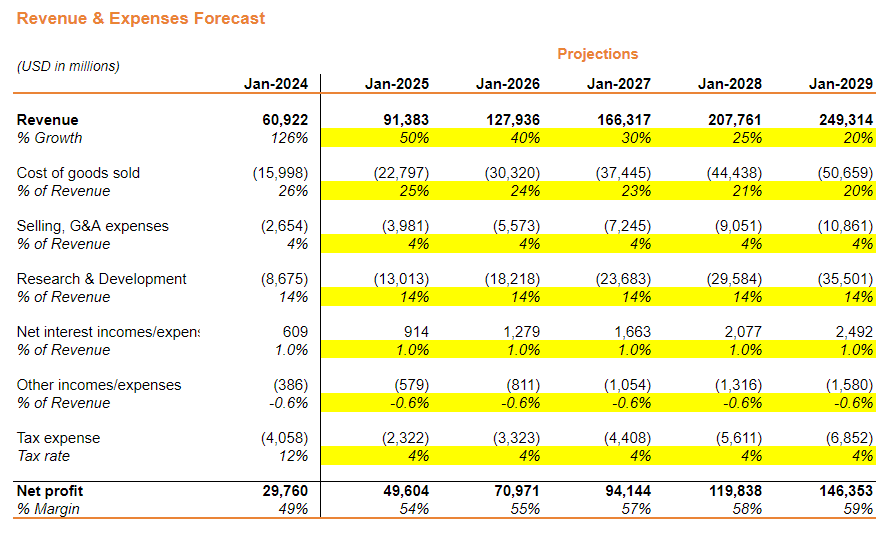

To elaborate further on the above calculations, we are using similar values to what we have in FY2024 with the exception of revenue growth rate. Based on the FY2025 forecasts, if we continue to see a quarter-on-quarter average growth of ~10% throughout the year, we can expect the total revenue to grow close to 46% in FY2025. We then realistically expect a slowdown in the growth rate over the next few years to 20% in FY2029.

Using the above calculations and forecasts, as well as using a discount rate of 10.55% and a long-term terminal growth rate of 4%, we end up with a fair value of $804.62. Based on the last close price of $950.02, this represents a downside of approximately 15.3% which means NVIDIA is currently overpriced based on my forecasts and estimates.

Final Thoughts

In conclusion, NVIDIA remains an attractive investment opportunity in 2024, driven by its market leadership, diversified revenue streams, exposure to high-growth markets such as AI and gaming, technological innovation, and favorable industry trends. Despite it being overvalued based on my DCF valuation, it is still a very strong company with a very compelling bull case that investors cannot ignore. If NVIDIA continues to grow aggressively quarter-on-quarter, we might see its share price continue to rally upwards.