Ascendas REIT (SGX: A17U) is Singapore’s first and largest listed business space and industrial REIT. In terms of market capitalization, Ascendas REIT is the largest listed REIT in Singapore right now with a market cap of S$12.9B. Ascendas REIT is a very well-known REIT as you can see its name printed on many industrial buildings in Singapore. In this article, I’ll be sharing with you if Ascendas REIT is a good buy right now.

Portfolio Overview

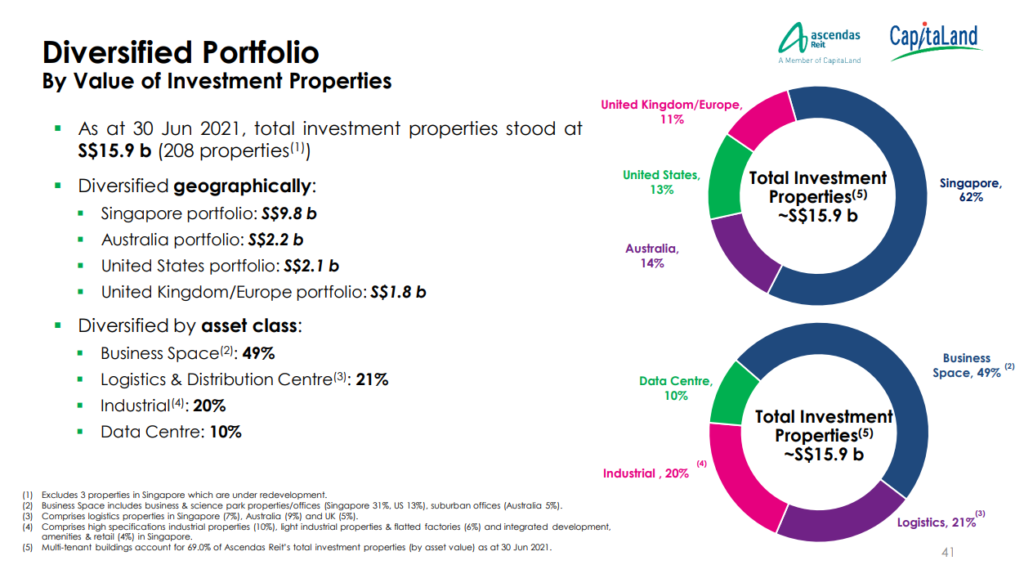

As of 30 June 2021, we can see the Ascendas REIT has a huge portfolio that is very well diversified across 4 countries. They also have about 60% of the portfolio in business parks and data centres which helps the portfolio stay resilient even in times of uncertainty like the COVID-19 pandemic. Another huge benefit of their well-diversified portfolio is the fact that no single property accounts for more than 3.6% of Ascendas REIT’s monthly gross revenue, an improvement from 6 months ago which was 4.2%.

1H 2021 Results

Strong Growth in Gross Revenue and NPI

| Year on Year Difference | 1H 2021 | 1H 2020 |

|---|---|---|

| Gross Revenue | S$586.0 million (+12.4%) | S$521.2 million |

| Net Property Income (NPI) | S$445.6 million (+14.8%) | S$388.0 million |

As we can see, Ascendas REIT posted strong growth in Gross Revenue as well as NPI year on year. This is mainly contributed by the newly acquired properties back in September and November 2020 as well as January 2021, and the 11 new data centres in UK/Europe which were recently acquired in March 2021. As the data centres were newly acquired, they did not fully contribute to the 1H 2021. As such, investors can expect to see a much stronger 2H 2021 as the new acquisitions will fully contribute to the period. It is good to note that the gross revenue also includes the Singapore government grant income pertaining to the property tax rebates received from IRAS.

DPU Grows as Distributable Income and Unit Base Increases

| Year on Year Difference | 1H 2021 | 1H 2020 |

|---|---|---|

| Distributable Income | S$311.0 million (+18.2%) | S$263.2 million |

| Distribution Per Unit (DPU) | 7.66 cents (+5.4%) | 7.27 cents |

As the Gross Revenue and NPI grow, the Distributable Income follows suit, growing by 18.2% year over year for 1H 2021. Due to the Private Placement in November 2020 and May 2021 as well as the Preferential Offering in December 2020, the total unit base grew by a sizable 12.2% to 4.06 billion units outstanding. Despite the huge growth in unit base, Ascendas REIT has still maintained growth in its DPU for shareholders by 5.4% to 7.66cents for 1H 2021.

Strong Balance Sheet

| As at 30 June 2021 | As at 31 December 2020 | |

|---|---|---|

| Aggregate Leverage | 37.6% | 32.8% |

| Interest Coverage | 4.6x | 4.3x |

| Average Cost of Debt | 2.4% | 2.7% |

Coupled with the strong set of results, Ascendas REIT has a very strong and healthy balance sheet. Despite their aggregate leverage reaching a high of 37.6%. a huge jump from 6 months ago at 32.8%, they still have a lot of room to grow. Due to its huge size, even though Ascendas REIT has a relatively high aggregate leverage, they still have a huge debt headroom of approximately ~S$4.2B before reaching the cap of 50%.

Not to mention their healthy Interest Coverage Ratio of 4.6x and low cost of debt at 2.4%, an improvement from 6 months ago at 4.3x and 2.7% respectively. I feel that it is important for REITs to lower their cost of debt in times like these where interest rates are at all-time lows. It is good to note that Ascendas REIT currently has the second-highest cost of debt as compared to its peers Keppel Data Centre REIT(1.5%), Mapletree Industrial Trust(2.7%), and Mapletree Logistics Trust(2.2%).

5-Year Performance

Revenue Growth

Note : Chart figures are in millions

As we can see, the overall 5-year trend for Ascendas REIT is up. This is due to the fantastic management that has been aggressively growing the portfolio through meaningful acquisitions as well as Asset Enhancement Initiatives (AEIs). It is not easy for a REIT to be growing so consistently over such a long time frame which makes it even more impressive that Ascendas REIT has done so well.

DPU

Note : Chart figures are in S$ cents

Ascendas REIT has been showing great DPU growth for the past few years taking into account that the number of shares issued is increasing year on year be it through equity fundraising or management fees being paid in units.

As we can see, the DPU did fall in FY2019 and FY2020 due to the enlarged unit base from the recent rights issue from acquisitions. Regardless, I’m still bullish on Ascendas REIT as the acquisition was DPU and NAV accretive while at the same time, decreasing their aggregate leverage by a large margin.

NAV Growth

Note : Chart figures are in S$ dollars

The 5-year trend shows that Ascendas REIT has managed to grow its NAV/share year on year despite the growing unit base. Not to mention the fact that Ascendas REIT is already so huge with such a large unit base so, for them to still be growing is really a commendable feat.

Potential Growth Catalysts

1H 2021 Investment and Divestment Highlights

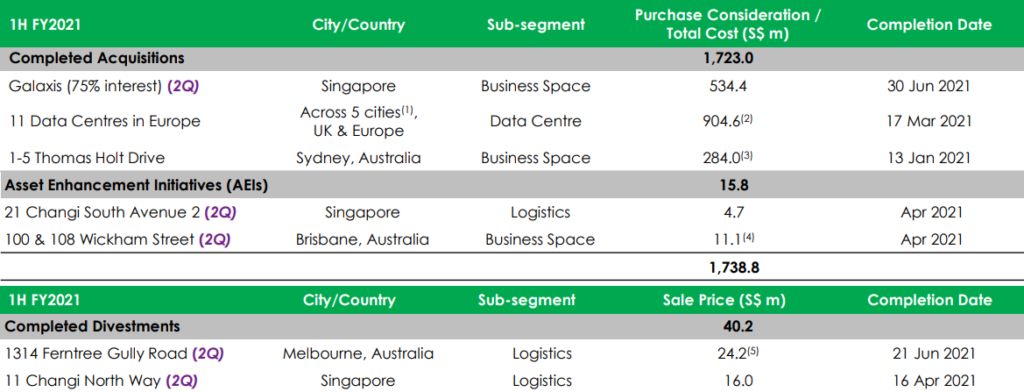

For 1H 2021, Ascendas REIT has completed a total of 2 Asset Enhancement Initiatives (AEIs), 3 acquisitions as well as 2 divestments. Let’s take a deep dive into the highlights and discuss if the management made a good call on these transactions.

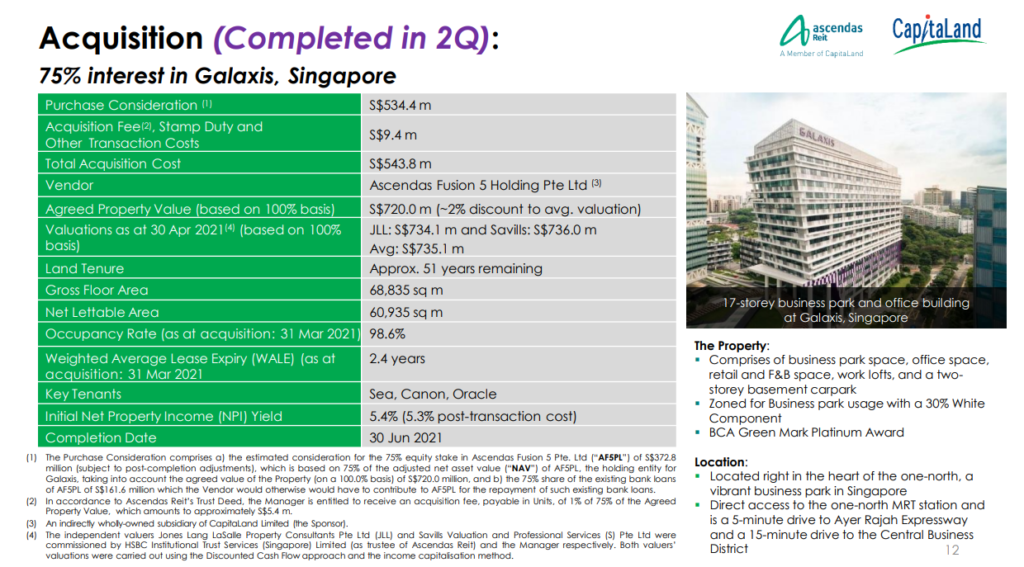

Firstly, the acquisition of 75% interest in Galaxis was definitely one of the best transactions made in 1H 2021 as it was bought at a slight discount of 2% to its average valuation. On top of that, the asset is a fantastic addition to Ascendas REIT’s portfolio with its high occupancy rate of 98.6% and high NPI yield of 5.4% (5.3% post-transaction cost).

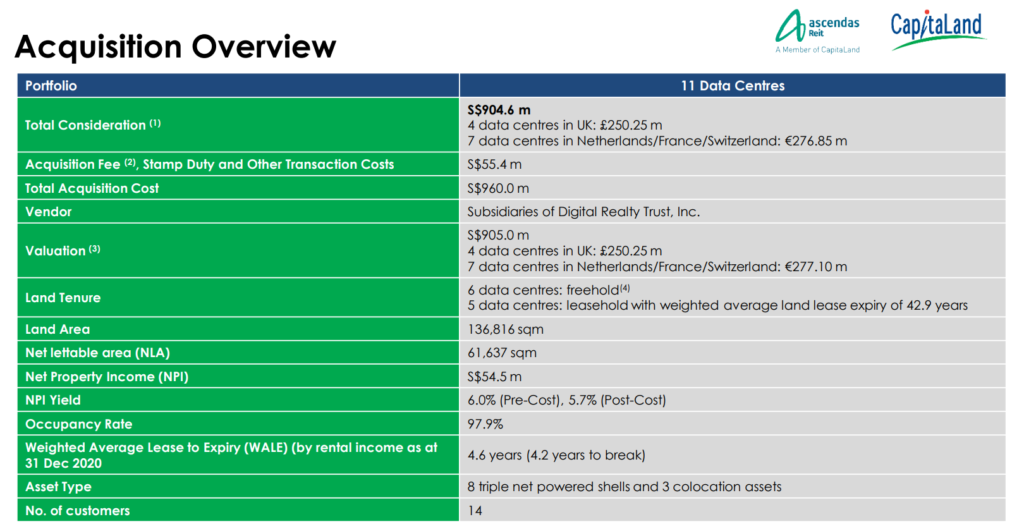

Secondly, the acquisition of 11 Data Centres across 5 cities in the UK and Europe was a fantastic addition to the portfolio as Data Centres are a core asset class with high resiliency. The overall acquisition was transacted near the total portfolio’s fair valuation of S$905m. Among the 11 Data Centres included 6 that were freehold with the remaining 5 being leasehold with a weighted average land lease expiry of 42.9 years. Coupled with its high NPI yield of 6% (5.7% post-transaction cost), the high occupancy rate of 97.9%, and WALE of 4.6 years, this basket of Data Centres will definitely boost Ascendas REIT’s portfolio.

Read Also: Ascendas REIT Goes Bargain Hunting In Europe For Data Centres

Apart from all these, there were minor AEIs as well as divestments during the period which amounted to a cost of S$15.8m and a net proceed of S$40.2m respectively. Moving into Q3 2021, Ascendas REIT expects the Grab Headquarters to be fully completed by 30th July 2021 as well as a completed divestment of 2 underperforming properties in Australia amounting to a net proceed of S$104.5m.

Leveraging On It’s Size

As we all know, Ascendas REIT is the largest industrial REIT in Singapore with a market cap of over S$12.9B. As such, even with a high aggregate leverage ratio, they can still fund huge acquisitions and AEIs. This gives them a huge margin to play with as compared to smaller cap REITs that need to do equity fundraising to make acquisitions happen.

At their current leverage of 37.6%, they have an approximate debt headroom of~S$4.2B before reaching an aggregate leverage of 50%. Just to illustrate how big that debt headroom is, Keppel DC REIT has a market cap of S$4.26B. This means that AREIT could potentially acquire Keppel DC REIT with the amount of debt headroom it has before reaching an aggregate leverage of 50%.

Current Valuation

Of course, before we invest in any company, we should always do it at the right price and valuation. Let’s take a look at Ascendas REIT’s current valuation based on its closing price today.

| PB Ratio | Annualized Dividend Yield | |

|---|---|---|

| Ascendas REIT ($3.08) | 1.37x | 4.974% |

As we can see, at its current valuation, you are paying quite a premium to own Ascendas REIT but, you need to keep in mind that Ascendas REIT is an industrial REIT. Industrial REITs are the least impacted during this COVID-19 pandemic. This allows them to stay above water and maintain high levels of cash flow. I believe that the huge premium is justified due to its huge size and its fantastic track record. Not to mention the fact that it is what I would call a “safe haven“. The yield of near 5% is also much better than the risk-free CPF SA rate of 4.5%.

| PB Ratio | Annualized Dividend Yield | |

|---|---|---|

| Keppel Data Centre REIT ($2.51) | 2.07x | 3.924% |

| Mapletree Industrial Trust ($2.85) | 1.63x | 4.702% |

| Mapletree Logistics Trust ($2.08) | 1.58x | 4.156% |

As compared to its peers like KDC, MIT, and MLT, we can see that Ascendas REIT is actually trading at a much fairer valuation with the lowest PB ratio as well as the highest annualized dividend yield.

Based on Technical Analysis, we can see that Ascendas REIT is near its uptrend support level and should bounce off beautifully and continue to trend upwards, breaking its near-term resistance of $3.15. Based on the RSI and MACD, we can see that the stock is on a slight uptrend but could start seeing a reversal soon as the RSI could rebound from the oversold region. A MACD divergence might serve as a confirmation that AREIT has rebounded and is starting a new uptrend.

Of course, when investing in the stock market, purely using TA and FA isn’t enough because sometimes, due to market euphoria, prices might get out of hand and never reach “fair valuation”. This is where we have to review our strategy and determine whether or not our set entry prices are reasonable. We should also determine whether or not a premium should be paid based on the company you are investing in.

Final Thoughts

Ascendas REIT will hold a very special place in my heart as it was the first REIT I bought when I first started investing. Before I started investing, I was looking for the biggest REIT in Singapore that showed consistent DPU growth year on year for the past 5 years and Ascendas REIT popped up. After some research, I decided to allocate close to 40% of my funds to buy Ascendas REIT.

This move might seem foolish at first but it turned out to be one of my best investment decisions till date. The rights issue rolled around in December and I took full advantage of it by subscribing to it in excess. I then proceeded to sell some of the excess I received to rebalance my portfolio as well as flip for some quick profits.

I have been waiting for a good time to enter Ascendas REIT but the valuation has not been very attractive thus far. I did buy some during the market crash @ $2.82 but later sold it for a small loss as I wanted to pick it up at a cheaper price. Since then, I have re-entered and exited Ascendas REIT along the way, pocketing some gains by accumulating as it dips near key support levels. Of course, as always, timing the market never works out as Ascendas REIT soon ran up to pre-covid levels and then went on to break all-time highs. My advice is to never time the market as more often than not, the market will turn around, bite you in the ass and leave you behind.

Pingback: REIT Posts of the Week @ 25 September 2021 | TheFinance.sg