With the Coronavirus vaccine being widely distributed across the world, we can expect the economy to start recovering in 2021. As such, investors are starting to look at retail and commercial REITs to ride the recovery trend as the economy bounces back. Mapletree Commercial Trust (SGX: N2IU) is one that has definitely gathered a ton of attention recently so I will be sharing my analysis on it. Without further ado, let’s get started.

Portfolio Overview

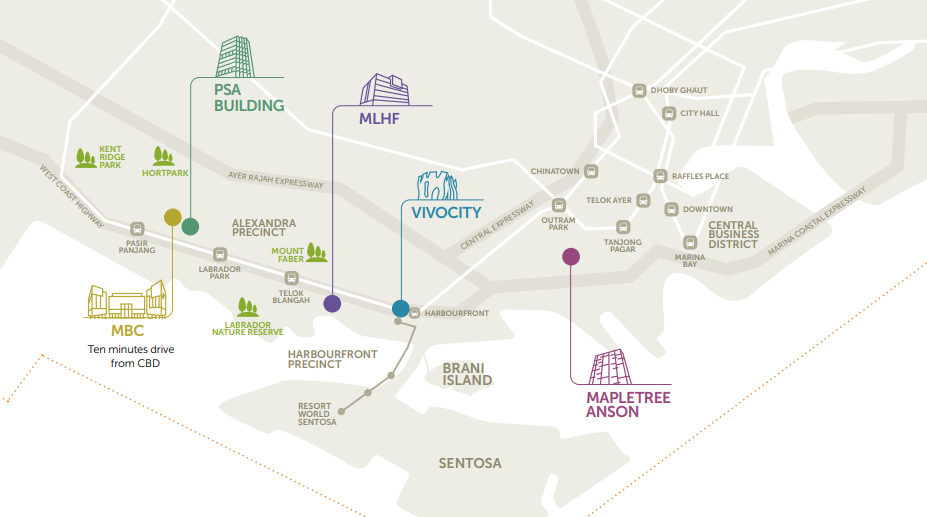

Mapletree Commercial Trust (MCT) has a total of 5 assets in its portfolio, VivoCity, MLHF, PSA Building, Mapletree Anson, and Mapletree Business City (“MBC”). MBC is split into 2, MBC I and MBC II which together, form one of the largest integrated developments in Singapore, comprising of one office tower and seven business park blocks supported by a retail F&B cluster.

FY20/21 Results

Resilient Performance Despite Poor Market Conditions

| Year on Year Difference | FY20/21 | FY19/20 |

|---|---|---|

| Gross Revenue | S$478.997 million (-0.8%) | S$482.825 million |

| Net Property Income (NPI) | S$377.01 million (-0.2%) | S$377.94 million |

Despite the rough year for commercial and retail REITs due to the pandemic, Mapletree Commercial Trust has managed to do very well thanks to the very resilient portfolio which includes their newly acquired MBC II. The Gross Revenue and NPI fell marginally by 0.8% and 0.2% respectively year on year. As compared to its peers, which have seen a much deeper drop in terms of performance, it goes to show how strong MCT’s portfolio is.

Strong Growth in Distributable Income and DPU

| Year on Year Difference | FY20/21 | FY19/20 |

|---|---|---|

| Distributable Income | S$314.72 million (+29.4%) | S$243.218 million |

| Distribution Per Unit (DPU) | 9.49 cents (+18.6%) | 8.00 cents |

On top of the resilient performance, they have managed to increase their Distributable Income and DPU substantially by 29.4% and 18.6% respectively. This is mainly due to the lower base set last year as MCT retained a total of S$43.7m in capital distribution to conserve liquidity in view of the pandemic. On top of that, the contributions from MBC II not only provided stability but strong growth to the overall portfolio.

Resilient Balance Sheet

| As at 31 March 2021 | As at 31 December 2020 | As at 31 March 2020 | |

|---|---|---|---|

| Aggregate Leverage | 33.9% | 34.0% | 33.3% |

| Interest Coverage | 4.4x | 4.2x | 4.3x |

| Average Cost of Debt | 2.48% | 2.51% | 2.94% |

Coupled with the strong set of results for FY20/21, Mapletree Commercial Trust has also maintained a relatively stable balance sheet with a conservative aggregate leverage of 33.9% and an interest coverage ratio of 4.4x. On top of that, MCT has also managed to bring down its average cost of debt from 2.94% the year prior to 2.48%. To put it in perspective, for every 25 bps (0.25%) change in Swap Offer Rate, it is estimated to impact the DPU by 0.06 cents. This means that the drop in the cost of debt has positively impacted the DPU by 0.1104 cents.

Portfolio Occupancy

Taking a look at MCT’s portfolio, we can see that the Occupancy Rates have been holding stable with VivoCity’s occupancy slowly recovering back to pre-covid levels. MBC I and mTower’s occupancy rate has been improving consistently as well so we can definitely expect a much stronger 1H FY21/22 for MCT. It is good to note that thanks to MBC II, Mapletree Anson and MLHF, the overall portfolio is very resilient, allowing MCT to perform much better than its peers.

5-Year Performance

After looking into Mapletree Commercial Trust’s portfolio, we will take a deep dive into its past performance and see if the REIT has managed to perform well over the last 5 years.

Revenue Growth

Note : Chart figures are in millions

Starting off with revenue growth, we can see that Mapletree Commercial Trust has been able to grow its Gross Revenue, NPI as well as Distributable Income consistently year over year with the exception of FY19/20 which is partially affected by the Covid-19 pandemic. This is why the Distributable Income fell year over year for FY19/20 as the REIT decided to retain some capital. Looking at FY20/21, MCT bounced back stronger with a much better set of results thanks to the recovery of the overall market.

DPU

Note : Chart figures are in S$ cents

Next up, one of the most important metrics to look at when analyzing a REIT, the Distribution Per Unit or DPU. We can see that Mapletree Commercial Trust has managed to grow its DPU year over year over the last 5 years with the exception of FY19/20 as the REIT retained some of its distributable income. It is also great to see that when you compare each half year over year, you can also see meaningful and consistent growth. Similarly, MCT’s FY20/21 results definitely proved to investors how resilient they are, not only improving from FY19/20’s DPU but FY18/19’s DPU as well.

NAV Growth

Note : Chart figures are in S$ dollars

Lastly, we also want to see NAV/Share growth because of 2 key reasons. Firstly, we don’t want a REIT that simply dilutes its shareholders by issuing an obscene amount of shares just to do an acquisition every time. Secondly, based on the theory/assumption that a REIT will always trade near its book value, meaning at a PB ratio of 1, we can see meaningful capital appreciation if the REIT can grow its NAV/Share consistently year over year.

As we can see, Mapletree Commercial Trust has managed to grow its NAV/Share meaningfully and consistently year over year with the exception of a small dip in FY20/21 due to the higher base set in FY19/20 as MCT retained some capital in view of the uncertain pandemic situation.

Potential Growth Catalysts

Now that we’ve looked into the REIT’s financials, we need to see if there are any potential growth catalysts that can catapult the REIT into new and greater heights. Let’s take a look at a few that I’ve identified for Mapletree Commercial Trust moving into 2H2021 and further out into 2022 as well.

Potential ROFR Pipeline Assets

Having a large and well-known parent like Mapletree standing behind the REIT, Mapletree Commercial Trust has the luxury of accessing a wide pipeline of ROFR assets. This pipeline includes:

- Harbourfront Centre

- Harbourfront Tower 1 and 2

- St James Power Station

- PSA Vista

- SPI Development Site

The total pipeline has a net lettable area of more than 1.7m sf and the management has definitely talked about the possibility of an acquisition in the near future. The manager will evaluate acquisition opportunities and ensure that they meet a few investment criteria such as value accretions, yield thresholds, and quality of assets before making any move.

With an aggregate leverage standing at 33.9%, there is a lot of debt headroom for acquisitions to take place even without any equity fund raising (EFR). Although, if the management chooses to do an EFR, I will definitely hop onto that opportunity as Mapletree Commercial Trust is a fantastic REIT to accumulate especially at cheap prices.

Greater Southern Waterfront

This is a fairly popular one that everyone has been talking about. In Singapore’s 2019 National Day Rally, the “Greater Southern Waterfront” plan was announced. The plan which extends from Pasir Panjang to Marina East, will transform the area into a new major gateway and location for urban living along Singapore’s southern coast.

Development will take place in phases, starting with the former Pasir Panjang Power District, Keppel Club and Mount Faber in the next 5 to 10 years. There will be approximately 9,000 private and public new homes to be developed on the site of Keppel Club, which is part of the earlier phases. There will also be a new MRT extension to the Circle Line as well as the upcoming Thomson East Coast Line which will be ready by 2025.

All of these factors will not only help contribute to Mapletree Commercial Trust’s portfolio but also its ROFR pipeline, which is mainly populated in the plan’s targeted area. The huge growth in the area will definitely benefit assets like VivoCity and the other commercial properties in the area.

Post Covid Recovery

With Singapore moving into Phase 3 starting 28th December, we can definitely see the light at the end of the tunnel. In addition to that, vaccines are being shipped into Singapore as well, further boosting investors’ confidence that the economy will slowly start to recover. Despite the rough start to the year, falling back into Phase 2.1 with restricted movement out, I’m sure our overall economy has stabilized and will continue to recovery beautifully back to pre-covid levels.

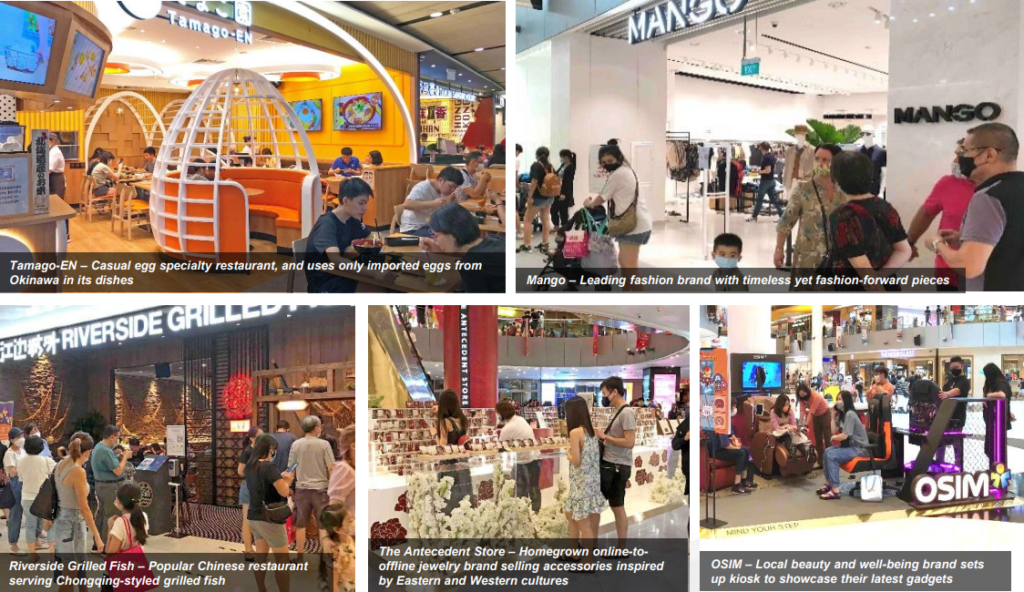

Previously, the management has been very active in revitalizing VivoCity in anticipation of the recovery wave in 2021. Firstly, the Mini-Anchor Space on L2 has been reconfigured so that there is more space to take on an additional tenant. Secondly, there is a revamp on the L1 promenade-facing F&B cluster which will help improve the layout to optimize space efficiency.

From their latest set of updates, the management has yet again, continued to revitalize VivoCity, helping its existing tenant, Adidas, to increase its store footprint by over 3x to now over 13,000 sf. On top of that, they have injected more tenants into their mix, bringing new and exciting variety to its shoppers.

Valuation

Of course, before we invest in any company, we should always do it at the right price and valuation. Let’s take a look at the current valuation of Mapletree Commercial Trust based on the last close price of $2.15.

| PB Ratio | Annualized Dividend Yield | |

|---|---|---|

| Mapletree Commercial Trust ($2.15) | 1.25x | 4.414% |

As we can see, Mapletree Commercial Trust is slightly overpriced with a PB ratio of 1.25x and a dividend yield of 4.414%. When compared to MCT’s historical average PB ratio of 1.15 and dividend yield of 5.02%, MCT is also seen to be slightly overpriced.

Valuation v. Peers

| Mapletree Commercial Trust's Peers | PB Ratio | Annualized Dividend Yield |

|---|---|---|

| Keppel REIT ($1.18) | 0.91x | 4.856% |

| OUE Commercial REIT ($0.405) | 0.69x | 6.000% |

| Suntec REIT ($1.46) | 0.71x | 5.070% |

As compared to its peers like Keppel REIT, OUE Commercial REIT, and Suntec REIT, we can see that Mapletree Commercial Trust is actually trading at a significant premium as compared to its peers. At first glance, an investor would wonder, why should I invest in MCT when its peers are much cheaper in terms of PB ratio and have a better yield. Although it might seem foolish at first, when we take a deeper dive into MCT’s peers’ results, we can see the exact reason why it is trading at such a big premium. While its peers have suffered greatly due to the pandemic, MCT has held on stronger than ever.

Based on the current valuation, Mapletree Commercial Trust does seem a little overpriced as compared to its peers but I feel that the premium is justified. Based on the above growth catalysts, Mapletree Commercial Trust has plenty of room to grow over the next 5-10 years. On top of that, I would much rather have a stable and consistent REIT that can generate growing dividends for me rather than bank on the “hope” that the REIT might recover to pre-covid levels.

Final Thoughts

Overall, Mapletree Commercial Trust is a fantastic REIT to buy and hold over the long term, even at its current price and valuation. The potential growth catalysts definitely justify the small premium you are paying and I like the fact that the REIT has been growing its DPU and NAV/share consistently year on year. I have since sold off my position in Mapletree Commercial Trust due to some portfolio rebalancing but I still maintain a very bullish outlook and will look to accumulate more when my portfolio has an open slot.