Block, previously known as Square (NYSE: SQ), has been one of the most prominent fintech companies in the world. Its product suite ranges from POS systems to its own finance app, Cash App. Unfortunately, due to the current high interest rate environment, Block has seen a big hit to its share price over the past year, falling by nearly 50%. With the recent Hindenburg Research report being very bearish against the company, is Block a falling knife that is worth sharing? In this article, we’ll delve deep into Block, analyzing the company from its financial performance and guidance to its growth in the international market and recent criticism over its accounting practices.

Introduction to Block Inc

Block Inc. is a financial services and digital payments company founded in 2009 by Jack Dorsey, also the co-founder and CEO of Twitter. The company offers a range of products, including Block Cash, Block Capital, Block Register, and Block Online. Block’s management team is led by CEO Jack Dorsey, who has been at the helm of the company since its inception.

In addition to Jack Dorsey, Block’s management team includes a diverse group of experienced professionals from various industries.

Amrita Ahuja serves as the company’s CFO, bringing more than 20 years of experience in finance and strategy to the role.

Other notable members of Block’s management team include Alyssa Henry (Block’s Executive Lead of Seller and Developer), Jesse Dorogusker (Block’s Hardware Lead), Brian Grassadonia, who leads the company’s Cash App division, and David Viniar, a former Goldman Sachs executive who serves on Block’s Board of Directors. This experienced and talented group of leaders has helped Block become a major player in the financial services and digital payments industry.

FY2022 Financial Performance

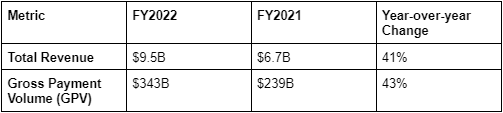

Block’s financial performance for FY2022 was impressive, with total revenue of $9.5 billion, an increase of 41% compared to the previous year. The company’s gross payment volume (GPV) also saw a significant increase, reaching $343 billion, an increase of 43% year-over-year.

Guidance for FY2023

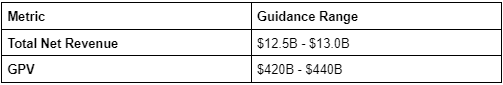

For FY2023, Block has guided total net revenue to be between $12.5 billion and $13.0 billion, representing a growth rate of 31% to 37% compared to FY2022. The company expects its GPV to continue to grow, with a projected range of $420 billion to $440 billion for the year. As highlighted, Block also plans to focus on expanding its services and products to more countries, specifically in Europe and the Asia-Pacific region.

Product Suite Growth

Block’s product suite has seen significant growth and changes in recent years, with a focus on expanding its offerings and enhancing existing products.

Block Register and Terminal

One of Block’s core products is its seller ecosystem, which includes Block Register and Block Terminal. This ecosystem has continued to expand, with the addition of new features such as inventory management, team management, and customer relationship management tools. In FY2022, Block’s seller ecosystem generated $3.7 billion in revenue, an increase of 35% year-over-year. The company also reported that GPV for its seller ecosystem grew by 40% year-over-year, reaching $165 billion.

Block Capital

Block Capital, the company’s lending arm, has also seen substantial growth, with loan volume increasing by 68% year-over-year to $3.5 billion in FY2022. This growth can be attributed to the company’s focus on providing small business loans, with an emphasis on quick and easy access to funding. Additionally, Block Capital has expanded its product offerings to include installment loans and cash advances.

The current high inflation and interest rate environment can have both positive and negative impacts on Block. On the positive side, it could lead to increased demand for Block’s lending services, particularly for small businesses that may be struggling to secure traditional loans from banks due to tighter lending standards. This increased demand could drive higher loan volumes for Block Capital, which could boost the company’s revenue.

However, on the negative side, higher interest rates could make it more expensive for Block to borrow money to fund its lending activities. This could result in higher costs for Block and potentially lower profitability. Additionally, if inflation continues to rise, it could erode the purchasing power of Block’s cash reserves and potentially impact the value of the company’s assets.

Overall, the impact of the current inflation and interest rate environment on Block will depend on a variety of factors, including the severity and duration of these trends and how they impact the broader economy and consumer behavior. Block will need to carefully manage its lending activities and monitor economic indicators to navigate this challenging environment.

Cash App

Block’s Cash App has also seen tremendous growth, with the user base increased to over 42 million active users as of August 2022. The app’s gross profit per user has also seen a substantial increase, with the company reporting $41 in gross profit per user for FY2022, an increase of 114% year-over-year. The Cash App has become an important part of Block’s ecosystem, with features such as direct deposit, debit cards, and cryptocurrency trading. Additionally, Block’s Cash App, a peer-to-peer payment app, saw a 130% increase in gross profit.

Block’s plans to expand its services and products in Europe and the Asia-Pacific region make sense, given the significant growth potential in these markets. The Asia-Pacific region, in particular, is experiencing a rapid rise in digital payments, with a projected compound annual growth rate (CAGR) of over 20% between 2021 and 2026. Block’s entry into these markets could provide the company with access to millions of new users and businesses, helping to drive further growth.

However, expanding into new markets is not without its challenges. Block will need to navigate regulatory hurdles and cultural differences to successfully establish a foothold in these regions. Additionally, the company will face competition from established players in these markets, such as Alibaba’s Alipay and Tencent’s WeChat Pay in China, and Europe-based companies such as Adyen and Stripe.

Block’s focus on developing its existing products, such as its seller ecosystem and Cash App, is also a wise move, as it can help the company to stay ahead of the competition and continue to provide value to its users. Enhancements to the seller ecosystem, such as inventory management and customer relationship management tools, can help Block to differentiate itself from competitors and provide more comprehensive solutions for small businesses. Similarly, improvements to the Cash App, such as the recent addition of stock trading capabilities, can help to attract new users and increase engagement among existing users.

Overall, Block’s plans for expansion and product development position the company for continued growth in the future. However, the company will need to carefully navigate challenges such as regulatory hurdles and increased competition to successfully execute these plans.

Hindenburg Research Report on Block

In March 2023, investment research firm Hindenburg Research released a report on Block, questioning the company’s accounting practices and alleging that the company’s seller ecosystem was facing significant competition. The Hindenburg Research report on Block accused the company of using “dubious tactics” to inflate its financial metrics and raised concerns about the sustainability of Block’s business model. The report claimed that Block’s seller ecosystem faced significant competition from established players like Shopify and Paypal and that the company’s reliance on lending through Block Capital could lead to increased credit risk.

The report also criticized Block’s acquisition of Afterpay, which the report claimed was overpriced and would not generate significant value for Block shareholders. Hindenburg Research alleged that Block had paid a premium for Afterpay’s growth potential, which it claimed was already priced into the company’s stock.

Following the release of the report, Block’s stock price initially dropped but quickly rebounded as the company refuted the allegations and reiterated its commitment to transparency and ethical business practices. The incident highlights the growing importance of investment research firms and the potential impact that their reports can have on public perception and stock prices.

Block refuted the report, stating that the allegations were false and misleading. In response to the report, Block has emphasized its commitment to ethical business practices and transparency in its financial reporting. The company’s CFO, Amrita Ahuja, also stated that Block’s accounting practices were in line with generally accepted accounting principles (GAAP) and that the company was confident in its financial reporting.

Furthermore, the company continued to focus on expanding its product suite and entering new markets, including the recent acquisition of Tidal, a music streaming service. While the Hindenburg Research report raised concerns about Block’s accounting practices and competitive position, the company’s strong financial performance and growth trajectory suggest that it remains a leader in the fintech industry.

Bull v Bear Case

Bull Case

The bull case for Block is that the company is a leading player in the rapidly growing fintech industry, with a strong track record of innovation and growth. The company’s focus on expanding its product suite, particularly in the international market, is seen as a significant growth driver. Additionally, the acquisition of Afterpay is expected to provide Block with a foothold in the growing buy-now-pay-later market, which is expected to be worth over $1 trillion by 2026.

Furthermore, Block’s Cash App continues to see impressive growth, with a user base of over 36 million active users and gross profit per user increasing by 114% year-over-year. The Cash App’s success is attributed to its ease of use, low fees, and the ability to invest in cryptocurrencies. As more people become comfortable with digital payments, the Cash App’s user base is expected to continue to grow.

Bear Case

However, the bear case for Block is that the company is facing increasing competition in its core seller ecosystem, particularly from large incumbents such as PayPal and Shopify. These companies have significant resources and established customer bases, which could make it difficult for Block to maintain its competitive position. Additionally, the Hindenburg Research report has raised concerns about Block’s accounting practices, which could erode investor confidence and lead to increased regulatory scrutiny.

Furthermore, Block’s reliance on Block Capital for revenue growth is seen as a potential risk, as it could expose the company to increased credit risk if the economy slows or if borrowers default on loans. Additionally, the company’s focus on expanding into new markets and products could lead to increased complexity and operational risk, which could impact the company’s financial performance.

Block’s reliance on Block Capital for revenue growth is a matter of interpretation, but it is worth noting that Block Capital’s revenue represented approximately 5% of the company’s total net revenue in FY2022. While this may not seem like a significant portion of revenue, it is worth considering that Block Capital’s loan volume has been growing rapidly, with an increase of 68% year-over-year to $3.5 billion in FY2022. As such, any potential credit risk associated with Block Capital could have a meaningful impact on the company’s financial performance.

In conclusion, Block’s growth potential remains significant, particularly as it continues to expand its product suite and user base. However, the company faces increasing competition in its core seller ecosystem, and the Hindenburg Research report has raised concerns about the company’s accounting practices. As such, investors should carefully consider both the bull and bear case for Block before making investment decisions.

Final Thoughts

Block’s financial performance for FY2022 was strong, and the company’s guidance for FY2023 suggests optimism for continued growth. The company’s expanding product suite and Cash App user base are positive indicators for future growth. However, the Hindenburg Research report and increasing competition in the seller ecosystem market are potential headwinds for Block. Investors should monitor Block’s financial reporting and competitive position moving forward.