Shortly after Ascendas REIT (SGX: A17U) has posted their FY2020 results, they’ve gone shopping yet again, now in Europe. With the REIT’s huge debt headroom and the recent Equity Fund Raising, they managed to acquire the S$960m portfolio of Data Centres through a mixture of equity and debt. Let’s take a deep dive into this acquisition and its key highlights.

Acquisition Overview

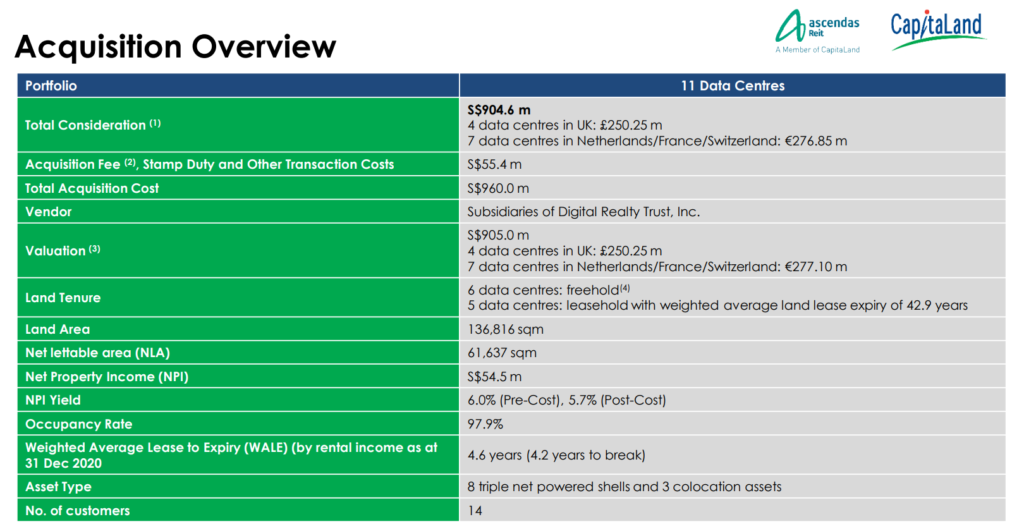

Taking a look into the acquisition overview, the portfolio being acquired consists of 11 Data Centres, 4 in the UK while 7 are in Netherlands/France/Switzerland. The total portfolio is last valued at S$905m and will be acquired at S$904.6m. The total acquisition cost including fees comes up to S$960m.

An interesting point is that this portfolio is bought over from subsidiaries of Digital Realty Trust, a very well-known Data Centre REIT listed in the US. This gives me a boost of confidence as Digital Realty Trust holds very strong assets across its portfolio.

6 of the Data Centres are freehold while the remaining 5 are leasehold with a weighted average land lease expiry of 42.9 years.

Key Highlights

After covering the acquisition overview, let’s jump right into some of the key highlights of this acquisition.

Triple Net Powered Shell

First off, let’s talk about the portfolio and especially, the type of Data Centres that are being acquired. 8 of the Data Centres are triple net powered shells while the remaining 3 are colocation assets. So what are triple net powered shells?

Triple Nets consists of a base price, often quoted in $/kW, in addition to your proportional share of mutual operating expenses plus monthly Critical Load consumption and Essential Load costs. I’ve also listed the pros v. cons in the table below for reference.

| Pros | Cons |

|---|---|

| Increases operating cost transparency for clients | Increases accounting and cash flow complexity for clients = higher admin burden |

| Clients can benefit from lower than expected operating expenses | Customer assumes the risk of higher than expected operating expenses |

| Clients can collaborate with landlord to make systematic efficiency improvements | More variability in costs over the term of the lease |

I personally like the lease structure and think that it’s fantastic for the REIT because costs are shared so the clients would be incentivized to help improve the efficiency of the entire layout to help lower operating expenses.

Fantastic Asset Location

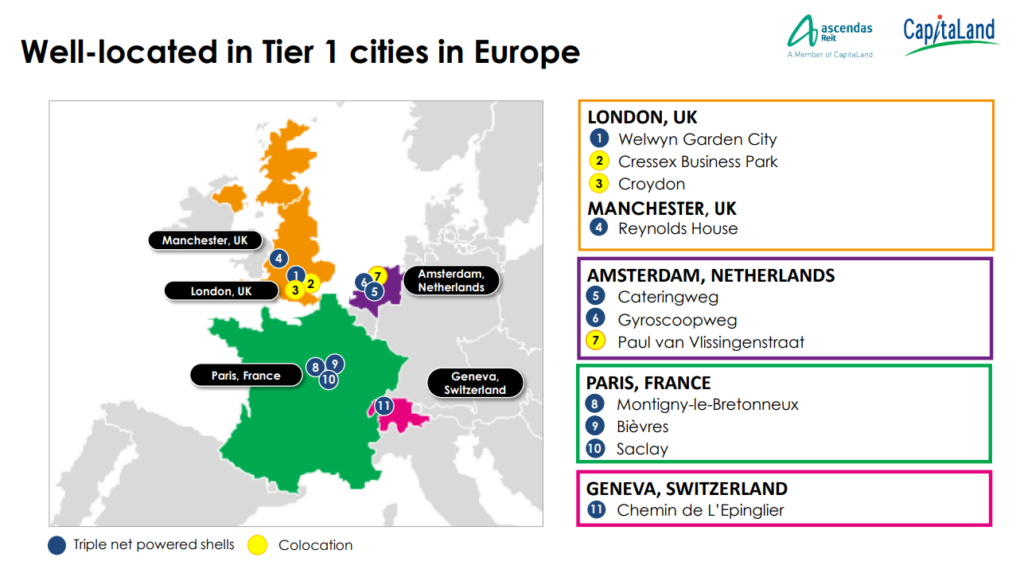

Moving onto the second key highlight, the assets are very well located across tier 1 cities in Europe. As such, they are priced at a higher rate as compared to lower-tier cities. These Data Centres also get to enjoy robust growth as the entire world is moving onto the cloud.

DPU Accretive

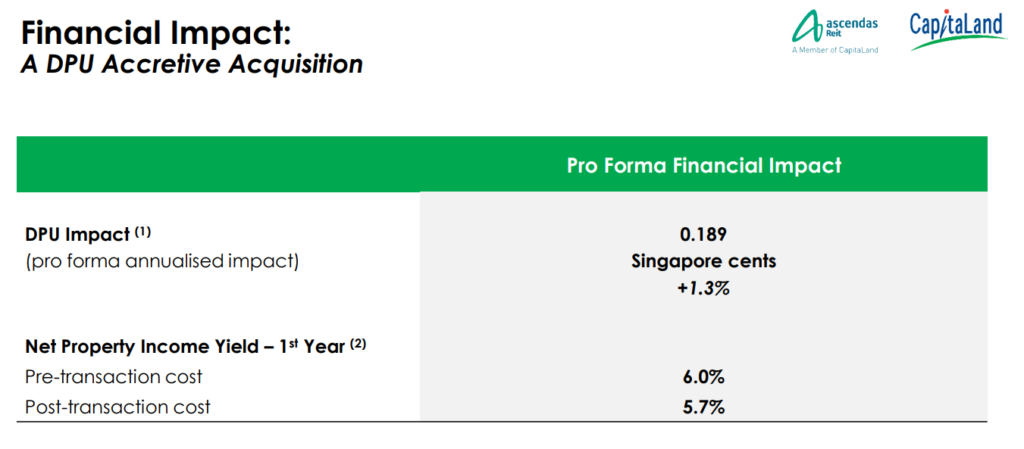

The acquisition is DPU accretive, which is great for investors. The DPU is expected to improve by 1.3% or 0.189 cents. Do note that the calculation is based on a few assumptions such as

- Ascendas REIT completes the acquisition on 1st Jan 2020 and holds it through 31st Dec 2020

- The proposed acquisition is funded by equity of approximately S$612.5m

- The manager elects to receive its base fee, 80% in cash and 20% in units

To clear any confusion, the equity that funds this acquisition was done through an Equity Fund Raising of S$1.2B completed on 9th Dec 2020.

Enhanced Portfolio

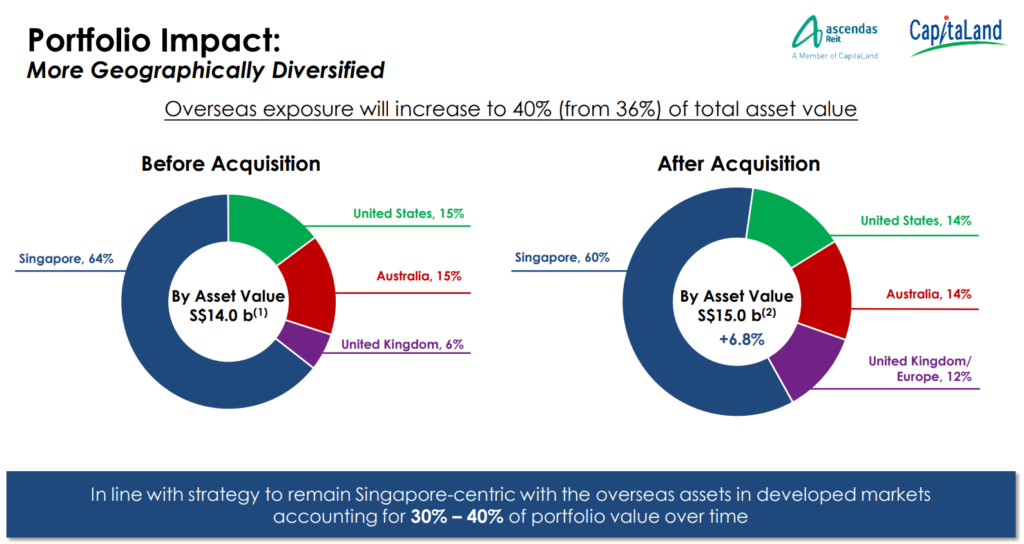

Post-acquisition, Ascendas REIT’s portfolio will be further diversified with a 6.8% increase in its AUM. The portfolio will have an increase in its UK/Europe Exposure from 6% to 12% while reducing its Singapore exposure by 4% and its US as well as Australia exposure by 1% each.

Overall, the acquisition is in line with the manager’s strategy of ensuring that the portfolio remains Singapore-centric, with its overseas assets accounting for 30%-40% of its portfolio value.

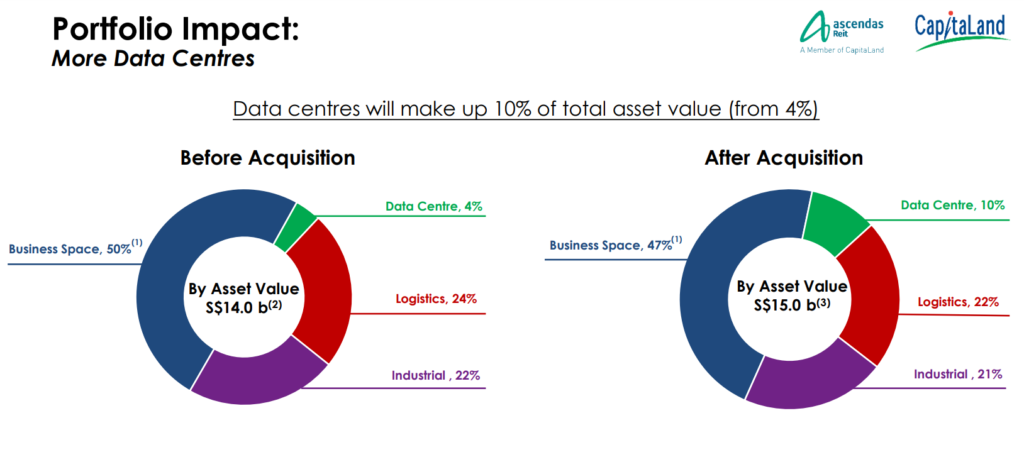

In addition to that, the overall portfolio will now have increased exposure to Data Centres, from 4% to 10%. This is really important because Data Centres are definitely the next big trend moving into the next 5-10 years so this positions Ascendas REIT well for the future.

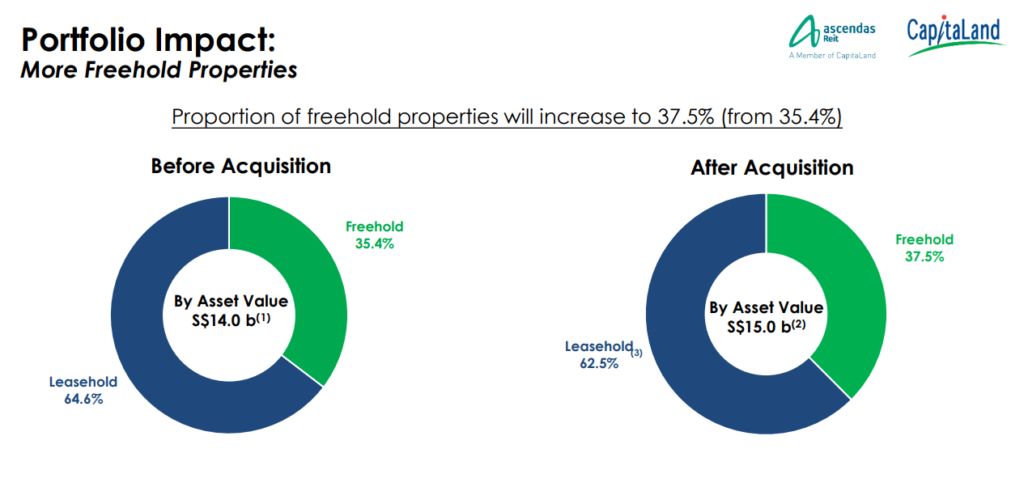

Not forgetting the fact that the portfolio will now have an increased proportion of freehold assets from 35.4% to 37.5% which is a very good sign as freehold assets are highly valued as compared to leaseholds, especially when it comes to Data Centres.

Is Ascendas REIT Still Attractive?

The golden question that everyone is asking now that Ascendas REIT has climbed a substantial amount after my recent post.

Read Also: Is Ascendas REIT A Good Buy Now?

Based on the expected Pro-forma DPU of 14.877 S$ cents, Ascendas REIT now carries an attractive 4.83% yield based on its last closing price of $3.08/share. Now, this is still pretty attractive as it beats the CPF SA yield and can also bring in capital gains as well.

With Technical Analysis, we can see that Ascendas REIT has been having a fantastic run thus far, bouncing off a key support level and now moving into a key resistance level near the $3.10 price range. The RSI is starting to reach overbought levels so investors should be cautious as a pullback could happen in the near term. The MACD has also just converged, signaling a bullish reversal. With this, we can see that 2 indicators are showing a bullish reversal while 2 other indicators showing that a short-term pullback could occur.

If Ascendas REIT can break through the $3.10 price range over the next week and stay above the resistance, it should be well-positioned to challenge the $3.16 resistance level.

Final Thoughts

As mentioned in my previous article on Ascendas REIT, they have a huge debt headroom to play with and can easily acquire huge portfolios at one go without doing any huge Equity Fund Raisings, which could be dilutive for shareholders. I personally really like this acquisition and can see that Ascendas REIT is taking the right step forward, moving more into the Data Centre market. They can definitely start to compete with the likes of Mapletree Industrial Trust as well as Keppel DC REIT.

The current valuation is definitely attractive for long-term investors or income/dividend investors as the yield is still high despite the low-interest rate environment that we are in. With bond yields climbing up, investors should be more cautious and think about the risk to reward when investing in the current state of the stock market.

Pingback: Is Ascendas REIT A Good Buy Now? - sgstockmarketinvestor