With 2021 starting off on a bad note with Singapore already back into Phase 2 in May, investors are now more cautious than ever with their investments. With our 3 local banks, DBS (SGX: D05), UOB (SGX: U11), and OCBC (SGX: O39) just released their Q1 2021 results, investors are wondering whether or not they should sell, hold or buy more of these local bank stocks. In this article, I’ll cover how well the 3 local banks did as well as whether or not they are still attractive at their current valuation.

Operating Performance

| Year on Year Difference | Revenue | Profit Before Allowances | Allowances Made | Net Profit |

|---|---|---|---|---|

| DBS | S$3.854 billion (-15%) | S$2.267 billion (-8%) | S$10 million (-99%) | S$2.009 billion (+72%) |

| UOB | S$2.486 billion (+11%) | S$1.397 billion (+16%) | S$201 million (-49%) | S$1.008 billion (+46%) |

| OCBC | S$2.914 billion (+17%) | S$1.739 billion (+26%) | S$161 million (-76%) | S$1.501 billion (+100%) |

Jumping right into the operating performance, we can see that DBS was the only bank that had its revenue fall year over year while OCBC grew the most at 17% and UOB lacking a little behind at 11%. Looking at the profits before allowance, DBS is lagging behind yet again, falling 8% year over year whereas its peers, UOB and OCBC grew by 16% and 26% respectively.

As our local banks move into a fresh new start in 2021, we can see a huge decrease in the number of allowances made as compared to the year prior. We can see that DBS made the largest cut in terms of allowances, from S$1 billion last year to just S$10 million this year. We can also see that UOB and OCBC have dropped the number of allowances made year over year by a significant margin as well. This is a good indicator to investors that the local banks are now more confident and expect fewer debts defaulting as the economy starts to recover faster.

Looking at net profits, we can see that DBS recorded yet another record quarter, crossing the S$2 billion mark, improving by 72% year over year. UOB also performed well with its net profit improving by 46% year over year as well. OCBC is definitely the clear winner here with its net profit almost improving 100% year over year.

Key Financial Ratios

| As at 31st March 2021 | Net Interest Margin | Cost/Income Ratio | Non-Performing Loans Ratio | Liquidity Coverage Ratios (LCR) | Leverage Ratio | Common Equity Tier 1 |

|---|---|---|---|---|---|---|

| DBS | 1.49% | 41.2% | 1.5% | 136% | 6.7% | 14.3% |

| UOB | 1.57% | 43.8% | 1.5% | 139% | 7.5% | 14.3% |

| OCBC | 1.56% | 39.4% | 1.5% | 151% | 7.8% | 15.5% |

Moving onto key financial ratios, and this is definitely the most important part when analyzing and evaluating a bank. At first glance, OCBC seems to be beating its peers with the 2nd highest NIM, 1bps behind UOB, and the lowest cost/income ratio. Just to recap, the Cost/Income ratio is used to see how well the company is managing its costs and spending to generate revenue. In essence, a low Cost/Income ratio signifies that the company is managing its costs well and is not overspending to generate revenue.

The LCR and NPL ratio seems to be rather consistent across the 3 local banks with OCBC taking a huge lead in terms of LCR, standing at a healthy 151%. In addition, OCBC has the highest leverage ratio at 7.8% and the highest CET-1 ratio of 15.5%. DBS’s leverage ratio is the lowest amongst the 3 local banks at 6.7% with UOB trailing ahead at 7.5%. Both DBS and UOB have the same CET-1 ratio of 14.3%.

Based on the financial ratios, we can see that OCBC has performed the best with the strongest balance sheet, 2nd highest NIM, and most efficient cost/income ratio.

Valuation

| Annualized PE Ratio | PB Ratio | Dividend Yield | Pre-Cap Dividend Yield | |

|---|---|---|---|---|

| DBS @ $29.86 | 9.51x | 1.46x | 2.41% | 4.42% ($1.32) |

| UOB @ $26.58 | 11.26x | 1.13x | 2.93% | 4.89% ($1.30) |

| OCBC @ $12.56 | 9.30x | 1.13x | 2.53% | 4.22% ($0.53) |

Before we make any investment, we must always make sure we evaluate the company properly first to avoid overpaying for any asset. Let’s jump right into the current valuation of the 3 local banks.

When looking at the dividend yield, UOB does take a slight lead but across the board, all 3 banks are currently priced with very low dividend yields, with DBS not even beating our risk-free OA interest rate. Despite this, many investors should look past this and evaluate the banks using the pre-MAS cap dividend to calculate the yield if they are planning to hold it for the long term.

Looking at the Pre-Cap dividend yield, we can see that UOB still takes a slight lead here at 4.89% with DBS trailing behind at 4.42% and OCBC taking 3rd place at 4.22%. Despite all this, based on current valuations, OCBC seems to be the best bargain with the lowest PE and PB ratio.

Should I Take The Scrip?

Now as we all know, MAS has imposed onto the 3 local banks to start offering scrip to shareholders as a way to maintain high liquidity. Many investors have been pondering over whether or not the scrip is worth it, taking into account that you might end up with odd lots and such.

Personally, I have been taking and will continue to take all the scrips, should the banks continue to issue them out. The reason being that the scrips are usually offered at a slight discount (in the case of OCBC) and the fact that you can buy more shares without incurring additional commission fees. Of course, for investors with large capital, commission fees are the least of your worries but for smaller investors like myself, each buy/sell transaction can add up to quite a lot of fees.

Not to mention the fact that I’m a long-term investor in the 3 local banks, I do not mind having odd lots because I’m not planning on selling them in the near future. They are under my “Dividend Growth” pie, companies that have a long history of not only giving out good dividends but also consistently increase them year over year. These companies are definitely bought and held for the long run as they keep on giving you larger paychecks as the years go by.

Scrip Calculator

Investors might sometimes wonder if it is worth it for them to take the scrip and, whether or not they are able to average down their holdings through the subscription of the scrip. Look no further because I have a simple solution for you. I’ve created a web app that will help you in deciding whether or not you should apply for the scrip.

You start by keying in some values such as the expected annual dividend for the stock, the number of shares you currently have, your average cost per share, the scrip issued price, and the amount of dividends declared this period. You also have the flexibility of choosing if you want to round off your scrips from 0.5 or from 1. Once you’ve done that, you can just click on the “Show Me My Scrips” button and it will display a table with values.

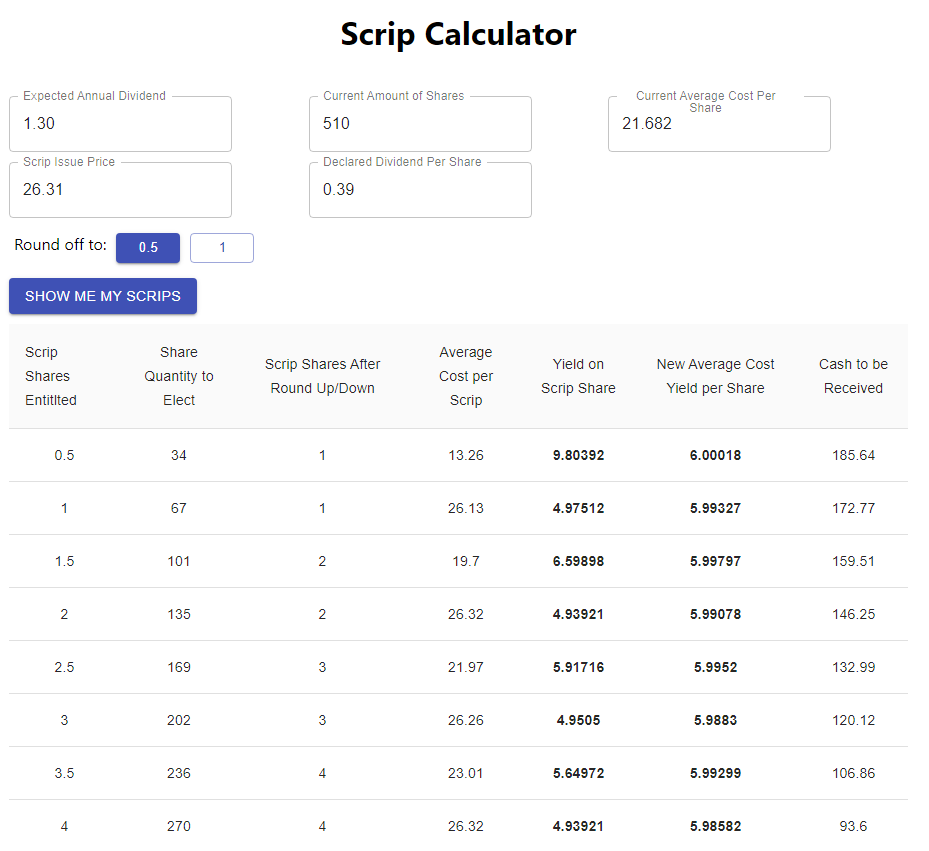

As you can see from the example above, which is based on my own portfolio, I have 510 shares of UOB at an average cost of 21.682 and I was considering partaking in the recent scrip which had a scrip issue price of $26.31. Since UOB allowed rounding up of fractional shares more than 0.5, I clicked on the “0.5” button as well. From the table, I can choose to go for 0.5 scrip shares so that my new average cost yield goes up to 6% or I can maximize my entitlement can get more. The table also tells you how many shares to elect based on how many scrip shares you want to receive.

This tool was developed by myself independently and I intend to make it free for use to help as my investors as possible. As such, if you have any ideas or suggestions to improve this app, please feel free to contact me and let me know.

Final Thoughts

OCBC has definitely performed the best as compared to its peers with UOB falling short by a small margin and last, DBS. DBS has surprisingly been overtaken by its peers for the first time in a while now as DBS has always been consistently ahead of its peers. I still have relatively large positions in all 3 banks because I am in it for the long term as mentioned previously.

Thanks to the use of the web app, I am able to see how much scrip should I take to ensure that my average cost doesn’t go up by a huge margin. As such, I have taken partial scrip entitlements and will continue to take the next few ones should the banks allow.

With the possibility of interest rates hiking again, banks are very well positioned, together with the post-pandemic recovery of the economy. I am also expecting banks to give out strong dividends over the next few years as they have very large cash positions with not much to do. Of course, we have seen DBS and OCBC start acquiring slowly but there will still be a large surplus of cash if MAS still restricts the 3 local banks to a low payout ratio.