Since the equity markets have been extra volatile over the past 12 months, risk-averse investors are actively looking for safer, fixed income investment alternatives that can generate a decent yield. In Singapore, apart from the traditional Fixed Deposits offered by banks, we have government bonds such as the Singapore Savings Bond (SSB) and Treasury Bills (T-Bills). We also have money market funds that are offered by brokers but we will be taking that out of the comparison as the returns are not guaranteed. Without further delay, let’s dive in and find out which fixed income investment is generating the best yield in Singapore.

Singapore Savings Bond (SSB)

As we all know, there is a new SSB issued every month which has a maturity tenor of 10 years. This month, the SSB issued is yielding an average of 3.07% p.a. across 10 years. The interest rate per year is as follows:

We can see that the yield is relatively stable for the first 7 years at a reasonable 3.00%. The yield then gradually increases upwards from the 8th year mark to 3.20%, and finally plateauing at 3.27% for the 9th and 10th year respectively. It is important to note that this month’s issuance is significantly lower than the Nov 2023 issuance which averaged 3.4%.

The benefit of investing in SSBs is that you can freely redeem your investment at any point in time for a small fee of $2. The interest gained will be paid out every 6 months. This provides investors flexibility in the case of an emergency where they need the money urgently, which makes SSBs a great investment vehicle for emergency funds as well. There is also a much smaller barrier to entry for SSBs with just a minimum of $500 per tranche.

Treasury Bills (T-Bills)

Moving on, we have T-bills. In Singapore, there are currently 2 types of T-Bills being issued, namely the 6-month and 1-year T-Bills. The 6-month T-Bills are usually issued twice a month whereas the 1-year T-Bills are less frequent. The interesting thing about T-Bills is that the interest rate is determined after the auction period has ended. As such, investors usually look at past issuances as a guideline.

| T-Bill Information (Code) | Cut-off Yield |

| 08 Nov 2023 6-month T-bill (BS23122F) | 3.75% |

| 23 Nov 2023 6-month T-bill (BS23123Z) | 3.8% |

| 07 Dec 2023 6-month T-bill (BS23124S) | 3.74% |

| 27 Jul 2023 1-year T-bill (BY23102N) | 3.74% |

| 19 Oct 2023 1-year T-bill (BY23102N) | 3.70% |

The latest 07 Dec 2023 6-month T-bill (BS23124S) had a cut-off yield of 3.74% p.a., which was lower than the 23 Nov 2023 6-month T-bill (BS23123Z) and 08 Nov 2023 6-month T-bill (BS23122F) which had a cut-off yield of 3.8% and 3.75% p.a. respectively. The latest 19 Oct 2023 1-year T-bill (BY23102N) had a cut-off yield of 3.70% p.a. This was marginally lower than the 27 Jul 2023 1-year T-bill (BY23102N) which had a cut-off yield of 3.74% p.a.

In the month of December, we have 3 6-month T-bills being issued which will be announced on the 30th of November, as well as the 13th and 27th of December. As we can see from the table, the 1st 6-month T-bill has already been announced and issued. It is important to note that there are no more 1-year T-bills being issued for the rest of 2023. You can find the full issuance calendar here.

Unlike SSBs, T-Bills do not pay coupons or interest. Instead, you buy T-bills at a discount to the face (par) value and are given the full value at maturity. In other words, if you were to buy $1,000 worth of the 6-month T-bill with a yield of 3% p.a., you would only need to pay $985 upfront. This is calculated by taking the yield earned ($1,000 * 3% * 0.5) deducted from the amount bought ($1,000). When the T-Bill matures, you will receive the full $1,000 back and earn $15. Do note that there is a slightly higher barrier to entry for T-Bills with a minimum of $1,000 per tranche.

Another difference between SSBs and T-Bills is that you cannot redeem it early. However, you can sell your T-Bills on the secondary market but do note that because the trading volume is relatively low, this makes T-Bills very illiquid on the market.

Fixed Deposits

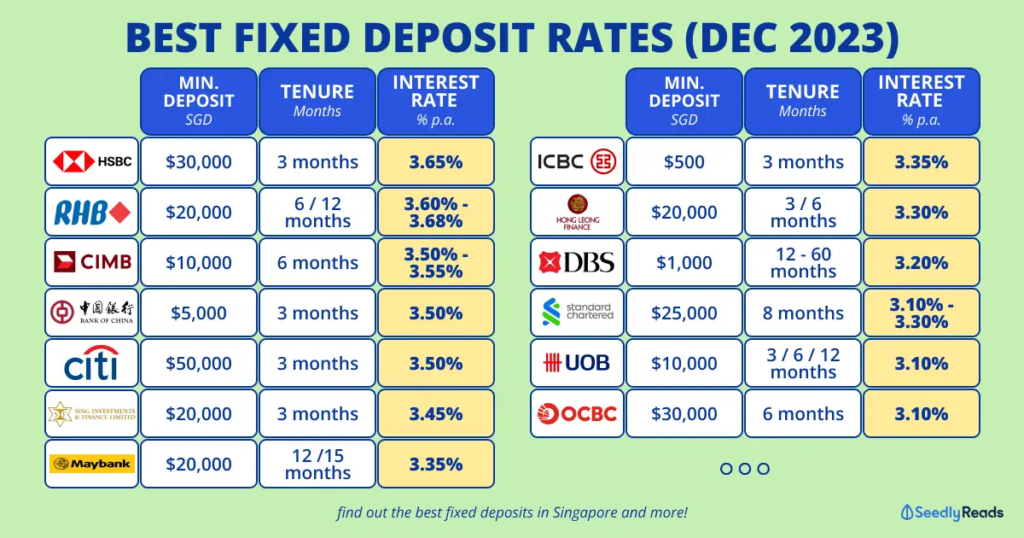

Last but not least, we have the traditional Fixed Deposits offered by banks. Unlike SSBs and T-Bills which need to be issued, banks are always offering Fixed Deposits but the interest rate offered will vary. This month’s Fixed Deposit rates are as follows:

As we can see, RHB is currently still offering the highest interest rate at 3.60 – 3.68% while OCBC is offering the lowest at only 3.1%. Each bank also has differing tenures ranging from 3 months to 12 months.

Final Thoughts

As investors, we can compare these 3 fixed income investments on 3 key factors:

- Yield

- Flexibility

- Barrier to Entry

Firstly, when we compare yield, we can see that Fixed Deposits will rank first with T-Bills taking a close second and SSBs ranking third. It is important to note that for Fixed Deposits, if we were to take the average across all banks, it would give you an average of 3.39% which is lower than T-Bills but higher than SSBs.

Secondly, when we compare the flexibility, SSBs will clearly rank first as you can withdraw at any time. Fixed Deposits will rank second as most banks will allow you to withdraw without any penalty but you won’t be able to get any interest earned up to the date of withdrawal. Last would be T-Bills as you cannot redeem them early. You can only sell them via the secondary market would is a hassle on its own.

Last but not least, when we compare barriers to entry, SSBs rank first with a minimum of $500 per tranche. T-Bills will rank second with a minimum of $1,000 per tranche and Fixed Deposits rank last as they vary across banks, with some requiring you to deposit fresh funds which is quite troublesome.

Overall we can see that for the month of December, similar to November and October’s results, SSBs take first place with the lowest score, T-Bills rank second, and Fixed Deposits rank third. Of course, it is important for investors to understand each product and find the perfect fit for you based on your investment needs.

Pingback: Which Fixed Income Investment Is The Best In Singapore? (Mar 2024)