Data centres are becoming a growing trend over the past few years as everything is being migrated to the cloud. Taking Keppel DC REIT (SGX: AJBU) as an example, a pure data centre REIT, it has grown from an IPO of $0.93/share to $2.39/share, not forgetting a total collected dividend of $0.50545/share. This comes up to a total return of ~211% from 2015 to date.

With another pure data centre REIT joining the market, investors are joining into the hype, expecting a similar performance to what Keppel DC REIT had in the past. With such a strong sponsor backing the REIT up, investors are definitely excited to see what Digital Core REIT has to offer with its IPO. Let’s take a deep dive into the IPO prospectus and better understand the key risks and rewards with regards to Digital Core REIT’s IPO.

IPO Overview

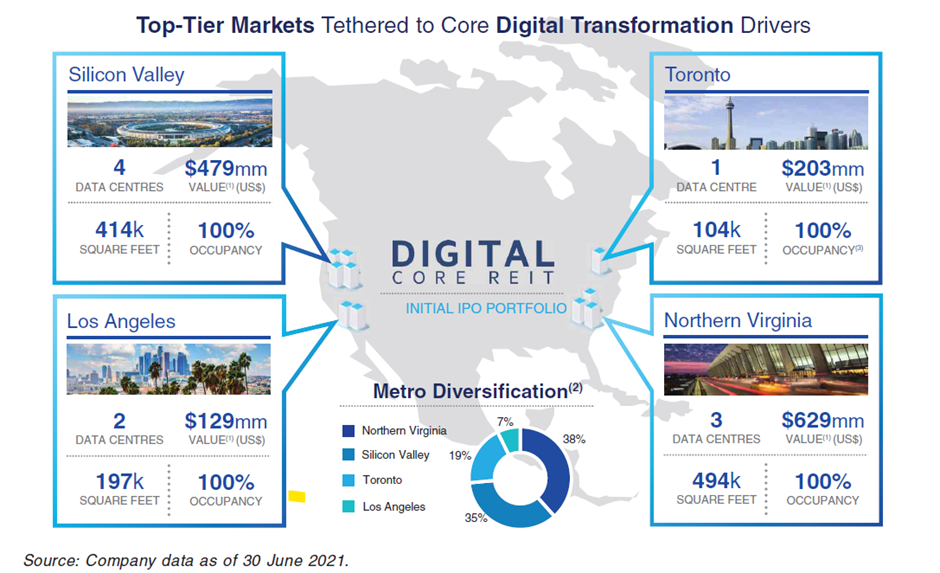

Digital Core REIT’s IPO portfolio includes 10 high-quality data centres spread across 4 top-tier markets in the USA. It is good to note that Digital Core REIT will own 90% of each asset while their sponsor, Digital Realty, will own the remaining 10%. The sponsor also holds a direct stake of 38.1% in the REIT itself.

Public v. Private Tranche

There will be a total of 267 million units on offer with Digital Core REIT’s IPO. The public tranche makes up for less than 5% of the total offering at 13.3 million units while the placement tranche makes up the remaining ~95% or 253.7 million units. The total number of Units in issue immediately after the closing of the offering will be 1,125m units, implying a market capitalization of US$990m given its IPO at US$0.88/share

Timeline

The overall IPO timeline is quite short with only 4 days for investors to apply for the IPO before the offer closes and the stock commencing trading just a week later.

| Opening date and time for the Public Offer | 29 November 2021, 9 pm |

| Closing date and time for the Public Offer | 2 December 2021, 12 pm |

| Commence Trading | 6 December 2021, 2 pm |

Strengths of the REIT

Now that we’ve covered the IPO overview, let’s discuss the strengths of the Digital Core REIT.

#1 Stable and Resillient Portfolio

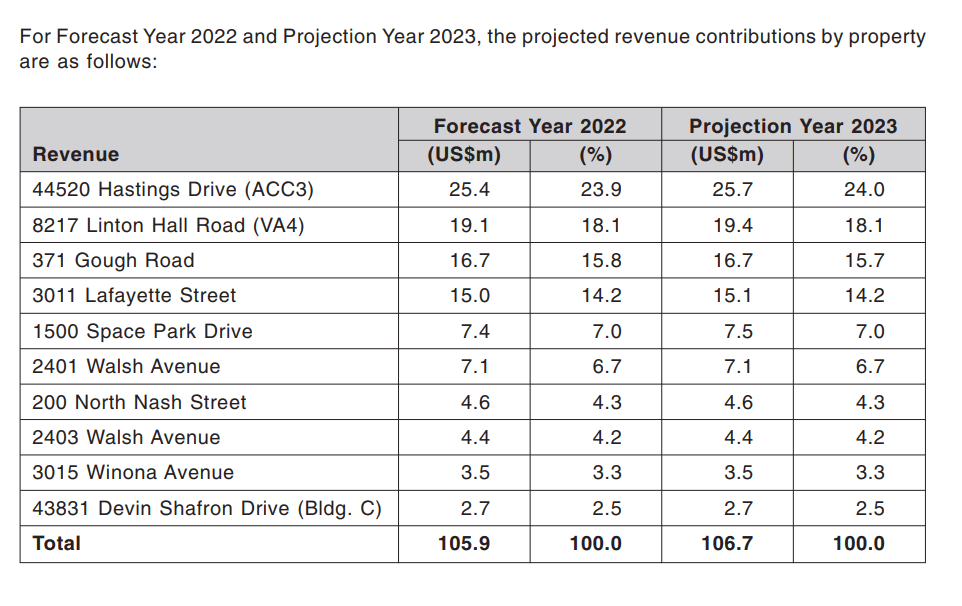

First off, let’s talk about the portfolio itself. Taking into account that data centres are a very defensive asset class, it shouldn’t come as a surprise that the overall performance has been and will be doing well. Looking at the forecasts for FY2022 and FY2023, Digital Core REIT is expecting moderate growth year over year for their current portfolio.

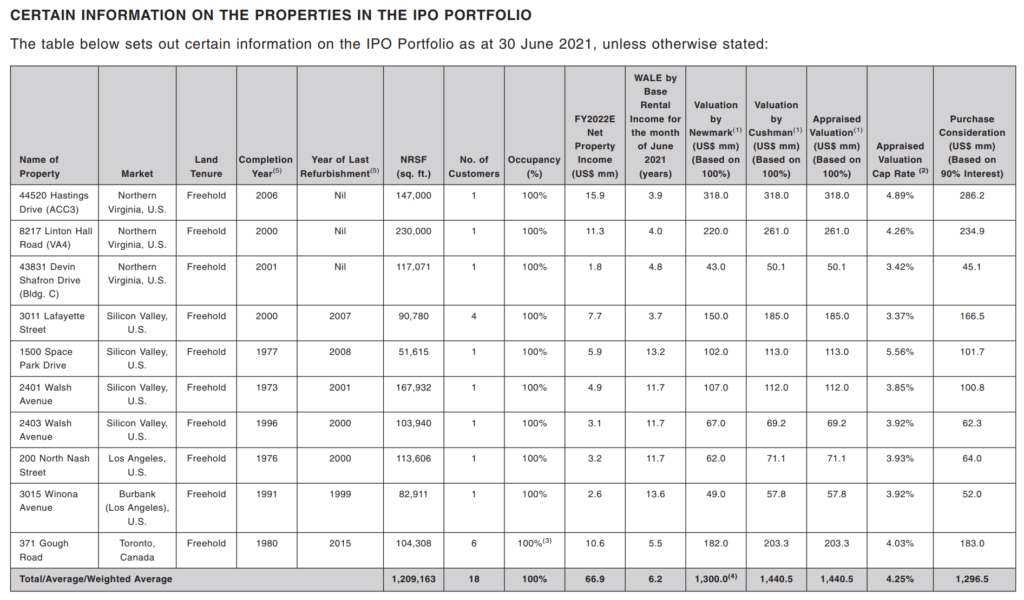

As we dive deeper into the individual assets, we can see that most of the data centres have concentration risk. Although most of them are only leased out to 1 customer, it is good to note that the WALE is relatively long at 6.2 years across the total portfolio. As long as the management stays proactive, always renewing their leases or finding new tenants swiftly, there isn’t much to worry about with regards to concentration risks.

#2 Strong Sponsor

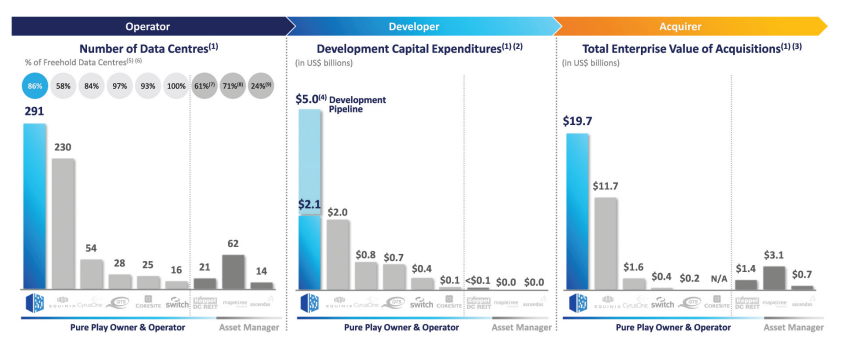

Every REIT will always have a sponsor behind them that can support them either through acquisitions or funding. This goes without saying that a strong sponsor can not only help aid but also accelerate a REIT’s performance over the long term. For Digital Core REIT, they have a very well-known sponsor, Digital Realty, which is also listed on the US market. To date, Digital Realty currently owns nearly 300 data centres across 26 countries.

With the help of such a strong sponsor, Digital Realty can pipeline Right of First Refusal (ROFR) assets down into Digital Core REIT over time to not only help grow the REIT but also recycle its own capital for further investments and growth potential.

At the moment, Digital Realty is providing a ROFR to Digital Core REIT for assets that are majority-owned by them globally, which can fit into the REIT’s investment mandate. These assets mentioned amounted to over US$15B. Not forgetting that Digital Realty also has an upcoming US$5B development pipeline which can benefit Digital Core REIT immensely over the long term.

Comparing Against Keppel DC REIT

With Keppel DC REIT (KDC) being the only other pure data centre REIT in the Singapore market, it is not a surprise that we are putting them head to head. In comparison with KDC, I’d say that Digital Core REIT has a lot more potential than KDC as it is listing with a market cap of US$1B (~SGD$1.36B) as compared to KDC’s current valuation at SGD$4.06B.

Of course, we are not saying that KDC is weaker than Digital Core REIT but in terms of capital gains, Digital Core REIT might present a much bigger upside given that its sponsor has granted a massive ROFR pipeline so that they can meaningfully grow over the next few years.

Portfolio

| Digital Core REIT | Keppel DC REIT | |

|---|---|---|

| # of Assets | 10 | 20 |

| Occupancy Rate | 100% | 98.1% |

| WALE | 6.2 Years | 7.0 Years |

First off, let’s compare the overall portfolio across the 2 REITs. Optimally, you’d prefer a REIT with a large portfolio of data centres so that it is well-diversified and not overly concentrated on any 1 key asset. Keppel DC REIT definitely wins in this aspect but it is also good to note that Digital Core REIT is still new whereas Keppel DC REIT has been around for over 6 years now.

When we compare occupancy rate, Digital Core REIT wins on this aspect with a full 100% occupancy rate for its overall portfolio as compared to Keppel DC REIT’s 98.1%. Despite this, it may not be a meaningful comparison because Digital Core REIT has a much smaller portfolio with only 1 tenant across most of their assets whereas Keppel DC REIT is more diversified with several tenants across most of its assets.

When comparing the last metric, Weighted Average Lease Expiry (WALE), Keppel DC REIT wins on this aspect but by a small margin. Both REITs do have long WALEs which is a great point to take note of.

Verdict: Keppel DC REIT Wins

Sponsor

Without a doubt, Digital Realty is a much stronger sponsor than Keppel. With its long track record in the data centre space and owning such a massive portfolio of data centres, Digital Core REIT wins over Keppel DC REIT in this aspect by a landslide.

Keppel DC REIT has a potential pipeline of assets over SGD$2B coming from data centres under development and management through Keppel T&T as well as Keppel’s private data centre funds. In comparison, Digital Core REIT already has a ROFR pipeline of over US$15B from its sponsor.

Given the number of opportunities Digital Core REIT will get to enjoy through its sponsor’s ROFR pipeline, there is a huge upside for Digital Core REIT to grow meaningfully over the long term.

Verdict: Digital Core REIT Wins

Key Metrics

| Digital Core REIT | Keppel DC REIT | |

|---|---|---|

| PB Ratio | 1.05x | 1.94x |

| Yield | 4.75% | 4.12% |

| Cost of Debt | N.A. | 1.6% |

| Gearing | 27.0% | 35.1% |

| Interest Coverage | N.A. | 12.2x |

Moving onto key metrics, we can see that Digital Core REIT is priced more attractively than Keppel DC REIT with a much lower PB ratio and much higher yield. Digital Core REIT has forecasted their FY2022 and FY2023 yield at 4.75% and 5.00% respectively. This represents a respectable 5.26% growth year over year. We will be moving past the cost of debt and interest coverage ratio (ICR) portion as this information is not yet available for Digital Core REIT.

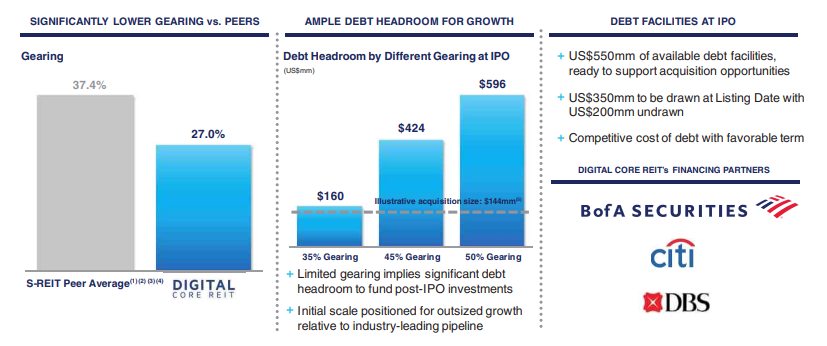

Digital Core REIT also has a very low gearing at 27% as compared to Keppel DC REIT’s 35.1%. Based on the IPO prospectus, Digital Core REIT has a debt headroom of US$160m, US$424m, and US$596m before reaching a gearing of 35%, 45%, and 50% respectively. This definitely opens up many doors and opportunities for Digital Core REIT over the next 24 months as they start acquiring from their sponsor’s ROFR pipeline.

Verdict: Digital Core REIT Wins

Final Thoughts

Other than the key risk mentioned in the article, concentration risk in each asset, Digital Core REIT seems to be a strong competitor against Keppel DC REIT in the data centre space. Being a highly defensive asset class, it is hard to achieve meaningful and organic growth without acquisitions. As such, having such a huge ROFR pipeline from its sponsor can prove very helpful for the REIT’s long-term growth potential.

Investors will need to stay cautious because although the sponsor is well-known, the management still plays a very big part in the overall performance of the REIT. If the management fails to align their interests with investors, the REIT might not be able to grow as fast or as meaningfully as investors expect.

Pingback: My Top 5 Exciting REITs To Watch in 2022