Mapletree Industrial Trust, a must have in every REIT investor’s portfolio. Their business is barely affected by the COVID-19 pandemic as they mainly own industrial properties such as data centres. They are already up over 20% year to date so let’s look at 4 key takeaways from the 1Q results of Mapletree Industrial Trust to help us better understand why they are doing so well.

1. Slight Drop In Gross Revenue But NPI Went Up

| Year on Year Difference | 1st Quarter 2020 | 1st Quarter 2019 |

|---|---|---|

| Gross Revenue | S$99.106 million (-0.5%) | S$99.575 million |

| Net Property Income (NPI) | S$78.652 million (+0.9%) | S$77.919 million |

As we can see, Gross Revenue fell year on year by about 0.5% partly due to rental rebates extended to tenants as part of the COVID-19 Assistance and Relief Programme. The effects are offset by increases in gross revenue. The higher gross revenue was mainly due to full quarter revenue contribution from 7 Tai Seng Drive and higher revenue contributions from The Strategy and 30A Kallang Place.

Property operating expenses fell by about 5.6% mainly due to lower property maintenance expenses, utilities, marketing commission partially offset by higher property tax and allowance for doubtful debts.

All in all, NPI still went up by about 0.9%. Though the increase is small, we have to keep in mind that after the COVID-19 pandemic has stabilized, the increase will be exponentially higher.

2. Theoretical DPU Went Up But Actual DPU Fell

| Year on Year Difference | 1st Quarter 2020 | 1st Quarter 2019 |

|---|---|---|

| Distributable Income | S$70.558 million (+11.6%) | S$63.241 million |

| Theoretical Distribution Per Unit (DPU) | 3.19 cents (+2.90%) | 3.10 cents |

| Actual Distribution Per Unit (DPU) | 2.87 cents (-7.4%) | 3.10 cents |

Mapletree Industrial Trust’s Distributable Income increased by 11.6% from the year prior. The increase was mainly due to the increase in NPI and distributions declared by joint ventures. It is partially offset by higher manager’s management fees. Distributions declared by joint ventures were higher due to distribution from Mapletree

Rosewood Data Centre Trust. Higher manager’s management fees were due to better portfolio performance and increased value of assets under management.

Mapletree Industrial Trust retained about S$7.1 million or 10.06% of the distributable income in view of the COVID-19 pandemic. Most REITs have adapted this policy as to help them tide over this tough time where tenants might not be able to pay rent.

The theoretical DPU if they did not retain any capital would be 3.19 cents, representing a 2.90% increase from the year prior. Taking into account the retained capital, the actual DPU fell to 2.87 cents, representing a 7.4% drop form the year prior. I urge investors to see past this short term issue as REITs are still mandated to issue out the retained portion of their income by the end of FY 2021 if they want to be eligible for the special tax treatment.

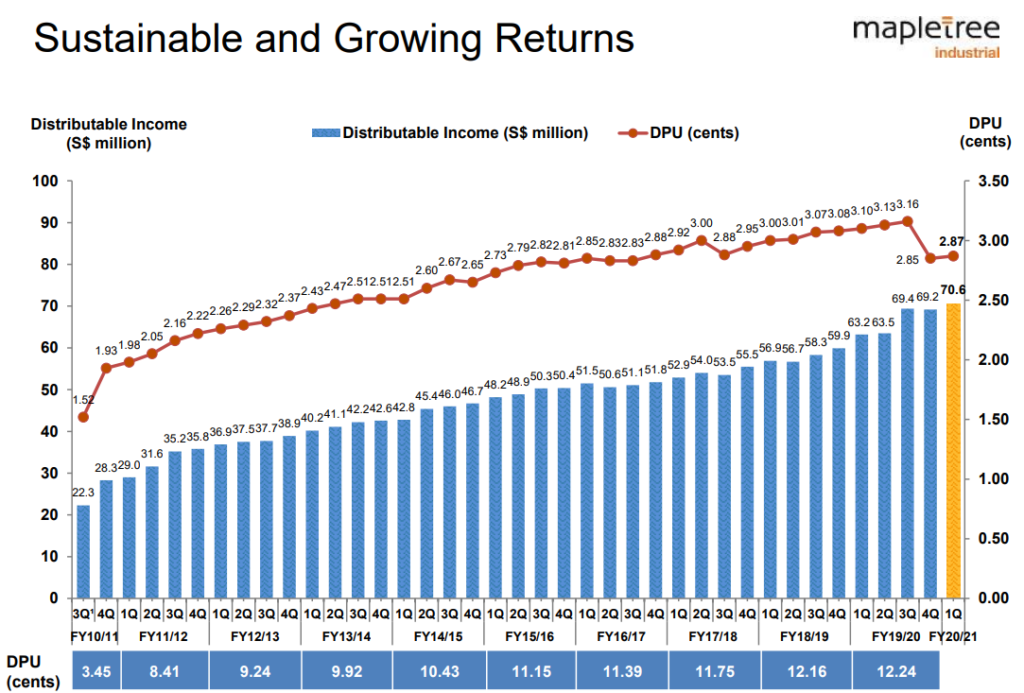

MIT has had a long track record of increasing their dividends not just year on year but quarter on quarter as well. This is a remarkable feat that is not commonly seen in Singapore REITs. I believe the only other REIT that has managed such a feat would be Keppel DC REIT.

3. Healthy Financials

| As at 30 June 2020 | As at 31 March 2020 | |

|---|---|---|

| Aggregate Leverage | 38.8% | 37.6% |

| Interest Coverage | 7.2x | 6.9x |

| Average Cost of Debt | 2.6% | 2.9% |

Mapletree Industrial Trust’s financials look very healthy, with an interest coverage ratio of 7.2x as well as a very low cost of debt at 2.6%. MIT’s gearing did increase significantly as compared to the year before when it was at 33.4%. This is due to the recent acquisition made on 23rd June whereby MIT entered into agreements with Mapletree DC Ventures Pte. Ltd., a wholly owned subsidiary of MIPL for the proposed acquisition of the remaining 60% interest in the 14 data centres in the United States of America currently held by Mapletree Redwood Data Centre Trust (“MRDCT”) at a purchase consideration of US$210.9 million (approximately S$299.5 million).

The agreed property value of the 14 data centres on a 60% basis is US$494.0 million (approximately S$701.5 million). Subject to Unitholders’ approval at an extraordinary general meeting and upon completion of the proposed acquisition, MIT will hold 100% interest in the 14 data centres. A private placement will take place to fund this acquisition.

Fund Allocation

Based on their announcement on 23rd June, the funds will be allocated as such based on assumed gross proceeds of approximately S$350 million from the private placement :

After the private placement, MIT announced that they issued a total of 146,414,000 units @ S$2.80 per unit. The private placement raised an estimated amount of S$410 million. With a larger amount being raised, I believe the funds will be allocated as such :

With a larger amount allocated to repaying debt, MIT’s gearing could see a drop of about 1% to 37.8% if they allocate 50% to paying down debt.

4. Data Centre Acquisition Has Yet To Kick In

The proposed data centre acquisition has yet to kick in and help contribute to MIT’s revenue. The acquisition is still subjected to Unitholders’ approval at an extraordinary general meeting. The chances of this acquisition failing is less than 0.1% because there is no logical reason as to reject such a wonderful acquisition. With the additional 60% interest in the 14 data centres, MIT’s data centres segment is expected to increase to 39.0% from 31.6% as at 31 March 2020, which increases MIT’s exposure to a resilient asset class with growth opportunities.

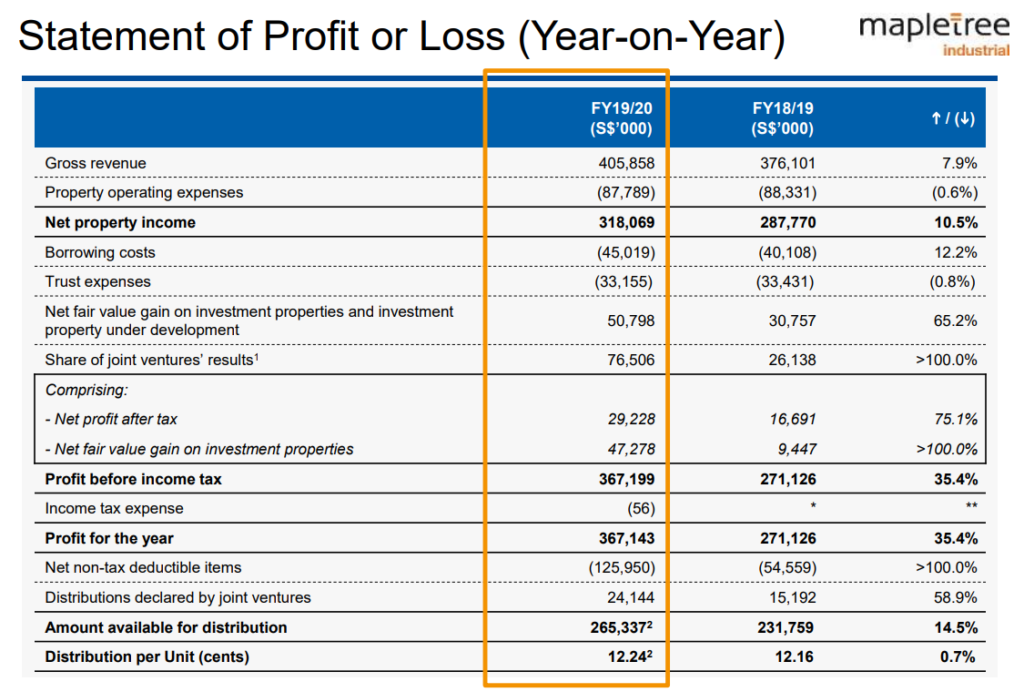

Using MIT’s results for the past 3 financial years, we can see that with just 40% interest, the growth in revenue is remarkable. Using the recent FY19/20’s results, we can see that with just 40% interest in the DC properties, the revenue already contributes to 20.8% of their total profit for the year. Imagine the amount of revenue growth they will see after the acquisition of the remaining 60% interest.

Final Thoughts

Overall, the 1Q results of Mapletree Industrial Trust is better than expected. The REIT has a very long track record of constantly performing better year on year. The only REIT that can be compared to it is Keppel DC REIT.

Mapletree Industrial Trust has averaged a 27.74% return p.a. including dividends over the past 10 years. Not forgetting the fact that because of the nature of MIT’s properties, they are not affected much by the COVID-19 pandemic, which is why MIT is already up more than 20% year to date.

I myself hold a position in MIT 2-3 weeks before they announced the acquisition. I shared this buy call with the members of my premium group and I’m happy to say that some of them even entered at a better price than me. I’ll be looking to accumulate more when the price shows weakness in the coming weeks to come.