Are you new to the stock market and don’t know what you should do to avoid losing half your portfolio through bad picks? Or perhaps you are an experienced investor/trader looking for fantastic opportunities and picks in the market that you might have missed out on?

If so, look no further because I am running a Premium Subscription that offers services such as:

- Access to both my Singapore and US Tech Watchlist with Preferred Entry Prices

- Telegram Group Invitation Where I Share Market Updates and My Personal Views

- Monthly Tradable Opportunities with Trade Setups

- On-Demand In-Depth Fundamental and Technical Analysis on Any Stock of Your Choosing

- Coverage on Several Basic and Advanced Options Strategies

Why should you subscribe?

- Strong Knowledge in Technology Industry

- Invest in Companies with Huge Long Term Upside & Little Downside

- In-Depth (Level 3) Analysis on all stock picks

- Buy in before anyone else takes notice

- Use various Options Strategies to Manage Risk as well as Significantly Improve Your Upside

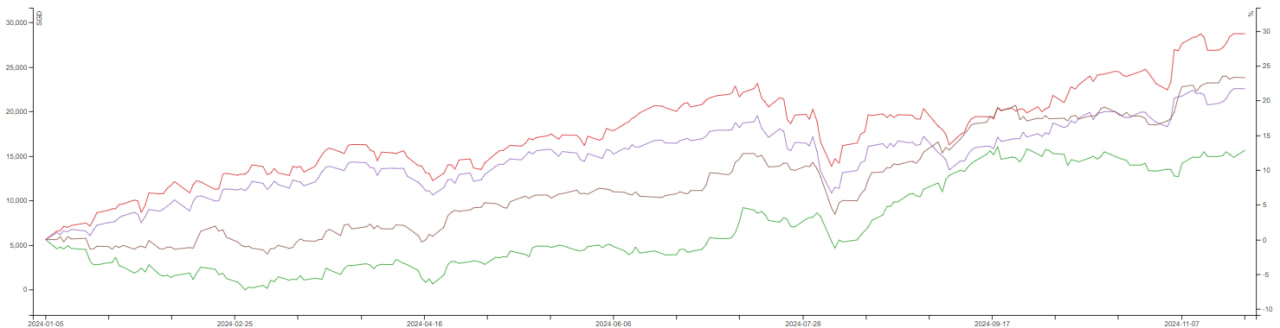

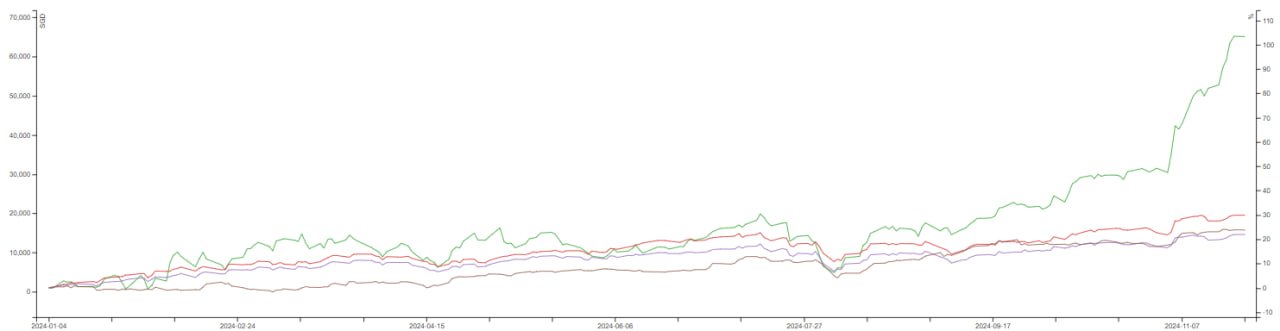

Watchlist Performance YTD

Guideline for tracking watchlist performance: Each stock will only be bought once unless it is removed from the watchlist. The buy price will follow the monthly entry price. Each position will be entered at <= SG$3,000 or US$2,000.

Legend:

![]()

Singapore Watchlist

The portfolio has underperformed all 3 key indexes. This is not surprising as the SG watchlist portfolio is rather conservative, focusing on dividends as a form of passive income. The portfolio has a cost yield of 7.71% which is very attractive given its low-mid risk profile with investments in REITs and banks.

US Watchlist

The portfolio has outperformed all 3 key indexes as expected, achieving more than 100% return. This is because the portfolio has a much higher risk profile investing in high-growth tech stocks.

Key Highlights

Palantir (NYSE: PLTR) – 645% Gain in 4 Years

I have been a deep believer and long-term investor of Palantir since it’s IPO. I have made countless buy calls from its initial IPO price of $9+ up to its peak in 2021 of around $45, and during its low period in 2022-2024. From the start till date, the stock has netted a 6x gain over the past 4 years. Providing a deeper look and perspective, if you started investing in 2023 which was the lowest period of Palantir, of which I was still DCA-ing deeply, you would have made closer to 7x in just 1.5 years.

Rex International (SGX: 5WH) – 203% Gain in 1.5 Years

I made a buy call for Rex on 10th April 2020. This was before the price crash and before OPEC finally agreed to cut the oil production on 12th April. This is a short to medium-term trade (18-24 months) and not meant for long-term holding.

After just 1.5 years, we have just locked in more than 200% in terms of gains through our investment in Rex International (SGX: 5WH) as the stock crosses our long-term TP of $0.30. In a slow-moving market like Singapore, achieving more than 100% gains in 10 years is very unheard of, let alone 200% gains in just 1.5 years.

CDL Hospitality Trust (SGX: J85) – 52.92% Gain (Incl. Dividends) in 9 Months

Initiated a buy on CDL Hospitality Trust during the midst of the covid-19 market crash with the foresight that the hospitality sector will recover by 2H2021. I also wrote an article stating my expectations and predictions in terms of DPU and overall performance.

Read Also: 4 Local Hospitality REITs! Is CDL Hospitality Trust The One For You?

XOM Call Options – 20% Gain in 1 Hour

I will often share option trade setups with some Technical Analysis as well as how to position the trade. Here is an example of how that is being done.

XOM Options Trade

This trade was shared on 9th October when there was strong bullish momentum in Oil due to the Israel-Hamas war. As XOM moved a lot higher in the premarket, the options pricing went up (Indicated $1.08 as compared to the opening price of $2.36) which caused the profit % indicated above to be lowered drastically. Nonetheless, this trade was opened and closed within the 1st hour of market opening, securing a quick 20% profit.

Tech Portfolio (2021) – 142% Gain in 11 Months

Here are some of our tech picks and how well they have performed thus far. Together with each pick is an in-depth analysis and explanation as to why it’s a good investment, what is the potential upside/downside, as well as what is a good price to enter each stock. Some of these positions have been old already while others are still held tightly in my portfolio.

If you have followed just these 7 picks alone, you would have achieved an average return of 142.66% in just under a year (on average ~339 days).

Still Not Convinced?

Here are reviews made by some of our current/past members

Pricing

Quarterly

-

Personal Watchlist

-

Telegram Group Invitation

-

Personal Mentoring

-

On-Demand In-Depth Fundamental and Technical Analysis

-

Coverage on Several Basic and Advanced Options Strategies

Yearly

-

Personal Watchlist

-

Telegram Group Invitation

-

Personal Mentoring

-

On-Demand In-Depth Fundamental and Technical Analysis

-

Coverage on Several Basic and Advanced Options Strategies

3 Year

-

Personal Watchlist

-

Telegram Group Invitation

-

Personal Mentoring

-

On-Demand In-Depth Fundamental and Technical Analysis

-

Coverage on Several Basic and Advanced Options Strategies

Join Now with

How Can I Join?

There are three different payment methods available. Please choose whichever is most convenient.

1. Via Paypal or Card

You can subscribe through PayPal or Card and it will automatically deduct the amount for you! Do note that if you don’t cancel the subscription, you will be automatically billed every cycle.

2. Via PayLah!/PayNow!

a) Please enter your Email Address or Telegram Username in the message box after scanning the QR code below!

b) Drop me a message notifying me of the contribution and I will follow up within 1-2 days!

3. Via Bank Transfer

a) You can do a bank transfer to Stanchart Savings Account 0128849002 with your Telegram Username as sender name.

b) Drop me a message notifying me of the contribution and I will follow up within 1-2 days!

Disclaimer :

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned on this website, in any of the articles; nor can the premium subscription’s material and/or documents be treated as professional advice to buy, sell or take any position in any shares, securities or other instruments. The information contained herein is based on the sole study and research of the sgstockmarketinvestor; and are merely the written opinions and ideas of the Author, and is as such strictly for educational purposes and/or for study or research only.

This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions.