Shortly after announcing an interesting divestment, Keppel DC REIT (SGX: AJBU) also announced its Q1 FY2024 results. Given the current high interest rate environment, could this divestment be a good move? In this article, we’ll deep dive into the 5 important takeaways from Keppel DC REIT Q1 FY2024 results, which also includes my analysis of the divestment.

1. Strong Improvement in Gross Revenue and NPI

| Year on Year Difference | Q1 FY2024 | Q4 FY2023 | Q1 FY2023 |

|---|---|---|---|

| Gross Revenue | S$83.364 million (+19%) | S$70.067 million | S$70.403 million |

| Net Property Income (NPI) | S$71.013 million (+34%) | S$53.013 million | S$63.888 million |

As we can see from the table above, Keppel DC REIT (KDC) is starting the year off strong with a net y-o-y increase in both its Gross Revenue and NPI. It’s also good to note that it grew q-o-q as well. This sudden increase came from the settlement sum received in relation to the dispute with DXC as well as positive reversions and escalations. The settlement sum from DXC will be distributed over 4 quarters in FY2024, which means we can expect the Gross Revenue and NPI to increase for the next 3 quarters. Guangdong DCs Q1 rental income continues to be recognized under Gross Revenue, but will be net off via loss allowance in Property Expenses. This will negatively impact the Q1 DPU by 0.326 cents.

2. Distributable Income and DPU Remain Weak

| Year on Year Difference | Q1 FY2024 | Q4 FY2023 | Q1 FY2023 |

|---|---|---|---|

| Distributable Income | S$38.791 million (-16.3%) | S$32.517 million | S$46.344 million |

| Distribution Per Unit (DPU) | 2.192 cents (-13.7%) | 1.840 cents | 2.541 cents |

Despite the strong growth in Gross Revenue and NPI, KDC’s Distributable Income and DPU remain weak due to higher finance costs, which also means the cost of debt. As with all REITs, the high interest rate environment is definitely catching up to them and will slowly eat into investors’ returns. As such, it would be wise for REITs to start adopting a higher percentage of fixed rate debt during this time. This can help provide more stability to the DPU which is very important for REIT investors.

3. Balance Sheet Improving Slowly

| As at 31 March 2023 | As at 31 December 2023 | |

|---|---|---|

| Aggregate Leverage | 37.6% | 37.4% |

| Interest Coverage | 4.6x | 4.7x |

| Average Cost of Debt | 3.5% | 3.4% |

Moving onto the financials, we can see that the aggregate leverage has increased slightly from 37.4% to 37.6%. The current aggregate leverage is at a manageable level because, with the current high interest rate environment, accretive acquisitions will be scarce. It will be more meaningful for the management to lower their debt during this time.

As we can see from the table above, the average cost of debt has increased slightly from 3.4% to 3.5%. KDC has also decreased its % of fixed debt slightly from 74% to 73%. This means that due to the remaining 27% unhedged borrowings, a 100bps increase would result in a ~2.6% impact on Q1 2024’s DPU on a pro forma basis.

The overall trailing 12-month Interest Coverage Ratio (ICR) has also decreased from 4.7x to 4.6x, which is still quite manageable as it is higher than 3x. The reason why I use 3x as a benchmark is because MAS proposed a new requirement for all Singapore REITs in Jan 2022, which states that S-REITs need to have a minimum of 2.5x ICR before they are allowed to leverage beyond the prevailing 45% limit (up to 50%). Allowing for some headroom, 3x ICR is a good benchmark to gauge if a REIT has sufficient room and flexibility to leverage higher for possible acquisitions.

4. Portfolio Stability

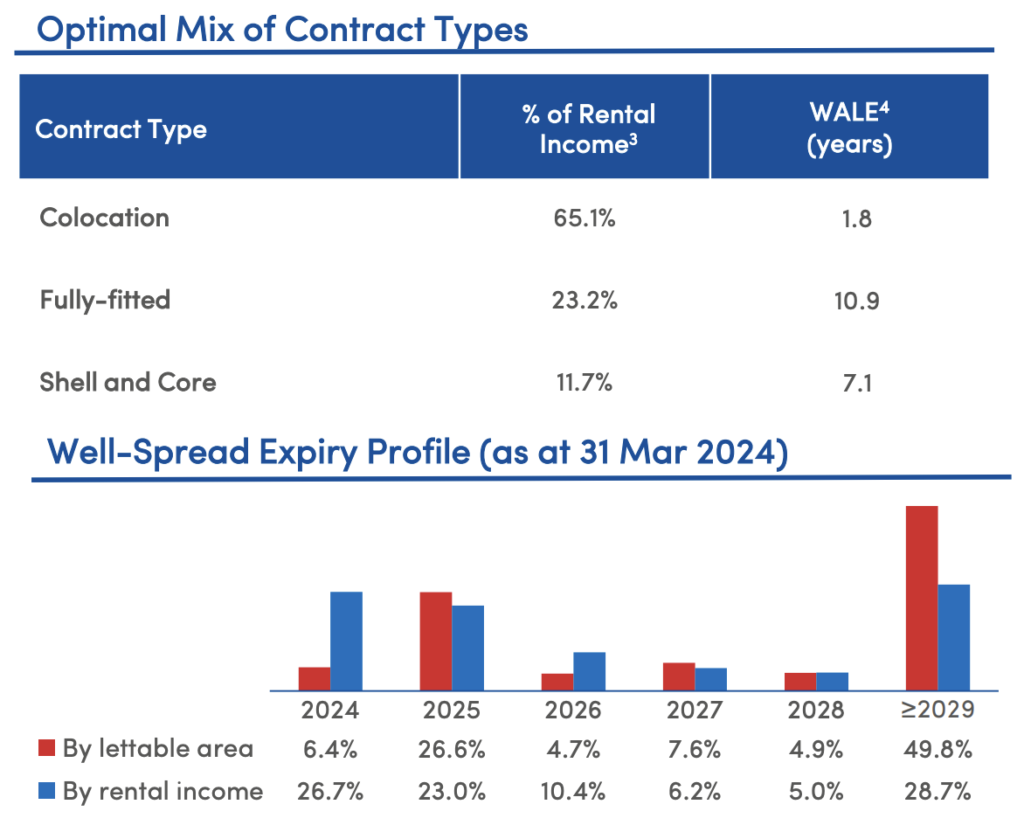

Looking at Keppel DC REIT’s portfolio, we can see that it is very resilient and stable with a strong portfolio occupancy of 98.3% and a long WALE of 7.4 years. The portfolio is very diversified across different contract types with a well-spread expiry profile. Based on rental income, we can see that 26.7% are expiring in 2024 and 23% are expiring in 2025, which means a little under 50% of the leases are expiring over the next 24 months. KDC did mention new and renewal contracts were secured but did not disclose if they were referring to the expiring leases in 2024 and 2025.

Following up regarding 2 tenants with issues recently, KDC has finished and won the dispute with DXC as mentioned above, resulting in a final settlement amount of S$13.3m. Regarding the Guangdong DCs, the tenant has settled part of the sums in arrears of RMB 0.5m (S$0.1m). The tenant will be working closely with KDC to slowly pay back the remaining sum owed.

5. Recent Divestment of Intellicentre Campus

On 16th April, KDC announced the divestment of Intellicentre Campus, an asset in Sydney, Australia, to Macquarie Data Centres. The agreed value of A$174m (~S$152.1m) represents a 35.4% premium over the property’s FY2023 valuation of A$128.5m (~S$112.3m) and 148.6% higher than the original investment of ~A$70m (~S$73m). In conjunction with this divestment, KDC will re-invest A$90m (~S$78.7m) towards an Australia Data Centre Note (AU DC Note) issued by Macquarie Data Centres Group. Through this AU DC Note, KDC will retain exposure to the Australia DC market, and receive a regular income stream starting from approximately A$6.3m (~S$5.5m) annually, with a CPI-linked annual escalation mechanism, for a total of 8.5 years. This income stream will mirror the rental KDC would have received from Intellicentre Campus if it had not been divested.

So what does this AU DC Note mean for KDC? This means that KDC will continue to enjoy the benefit of “owning” Intellicentre Campus without any of the underlying risks such as tenant issues. This transaction is expected to be 0.7% accretive to KDC’s pro forma FY2023 DPU as well as 1.5% accretive to KDC’s NAV per unit. With the net proceeds, the manager plans to repay existing loans of approximately A$43.2m (~S$37.7m) relating to the original investment of Intellicentre Campus. The remaining net proceeds of about A$22.3m (~S$19.5m) will be used for paring down debt, funding acquisitions as well as other capital expenditures. The pro-forma aggregate leverage is also expected to improve to 36.6%.

Final Thoughts

KDC’s Q1 FY2024 results were within expectations, excluding the DXC settlement, but the weak Distributable Income and DPU are definitely dragging on investors’ confidence. Even with its resilient nature, KDC has also fallen victim to the high interest rate environment. Nonetheless, the recent divestment is definitely a great move by the management, as it allows KDC to reduce its overall risk while still maintaining similar exposure to the Australia DC market. The AU DC Note is also well structured and beneficial for KDC as it provides a CPI-linked annual escalation.

Given that there are no unforeseen circumstances or issues, such as defaulting tenants, investors should definitely give KDC a look as it’s a fantastic REIT with a strong management team behind it. It won’t be surprising to see KDC shoot for an acquisition soon after the divestment has completed since the aggregate leverage has improved.