Keppel DC REIT (SGX: AJBU) is Singapore’s first pure Data Centre REIT, which is known to be quite resilient. Nonetheless, due to higher interest rates over the past 2 years, all REITs are badly affected by the higher cost of debt, and Keppel DC REIT (KDC) is not excluded. Many investors have avoided KDC due to its historically rich valuations but could this be a mistake? With its recent acquisition and Equity Fund Raising (EFR), could KDC be a worthy investment in 2025? Let’s take a deep dive into the 5 important takeaways from Keppel DC REIT FY2024 results.

1. Strong Growth in Gross Revenue and NPI

| Year on Year Difference | FY2024 | FY2023 |

|---|---|---|

| Gross Revenue | S$310.287 million (+10.4%) | S$281.207 million |

| Net Property Income (NPI) | S$260.286 million (+6.3%) | S$244.951 million |

Jumping right into the results, Keppel DC REIT posted a strong set of earnings with Gross Revenue and NPI growing by 10.4% and 6.3% respectively. This strong growth is mainly driven by 2 key factors: strong rental reversions across multiple major Singapore contract renewals in 2H 2024 and the newly acquired Tokyo DC 1. This growth is partially offset by the divestment of Intellicentre Campus and the income net off via loss allowances from Guangdong DCs.

2. Weaker Growth in Distributable Income and DPU

| Year on Year Difference | FY2024 | FY2023 |

|---|---|---|

| Distributable Income | S$172.733 million (+3.0%) | S$167.718 million |

| Distribution Per Unit (DPU) | 9.451 cents (+0.7%) | 9.383 cents |

Despite such a strong set of earnings, KDC’s Distributable Income and DPU saw much slower growth, at only 3% and 0.7% respectively. As mentioned, the income net off from Guangdong DCs impacted the 2H 2024 DPU by approximately 0.254 cents or ~2.69%. Fortunately, KDC’s finance costs decreased marginally due to lower cost of debt and interest savings from loan repayments made in 2024.

3. Balance Sheet Holding Steady

| As at 31 December 2024 | As at 31 December 2023 | |

|---|---|---|

| Aggregate Leverage | 31.5% | 37.4% |

| Interest Coverage | 5.3x | 4.7x |

| Average Cost of Debt | 3.3% | 3.3% |

Moving onto the financials, we can see that the aggregate leverage has decreased significantly from 37.4% to 31.5%. This is due to the recent EFR which helped pare down a lot of KDC’s debt. The current aggregate leverage is at an attractive level because, as interest rates continue to lower, KDC will be in a good position to start making accretive acquisitions.

As we can see from the table above, the average cost of debt has held steady at 3.3%. KDC has also decreased its % of fixed debt from 74% to 66%. Given the current downward trend of interest rates, this could prove to be a smart move as the overall cost of debt will likely decrease over time. This also means that KDC is more sensitive to interest rate hikes, with every 50bps change impacting the Q4 2024 DPU by approximately ~1.3%.

The overall trailing 12-month Interest Coverage Ratio (ICR) has improved from 4.7x to 5.3x, which is much higher than the baseline of 3x. The reason why I use 3x as a benchmark is because MAS proposed a new requirement for all Singapore REITs in Jan 2022, which states that S-REITs need to have a minimum of 2.5x ICR before they are allowed to leverage beyond the prevailing 45% limit (up to 50%). Allowing for some headroom, 3x ICR is a good benchmark to gauge if a REIT has sufficient room and flexibility to leverage higher for possible acquisitions.

4. Portfolio Stability

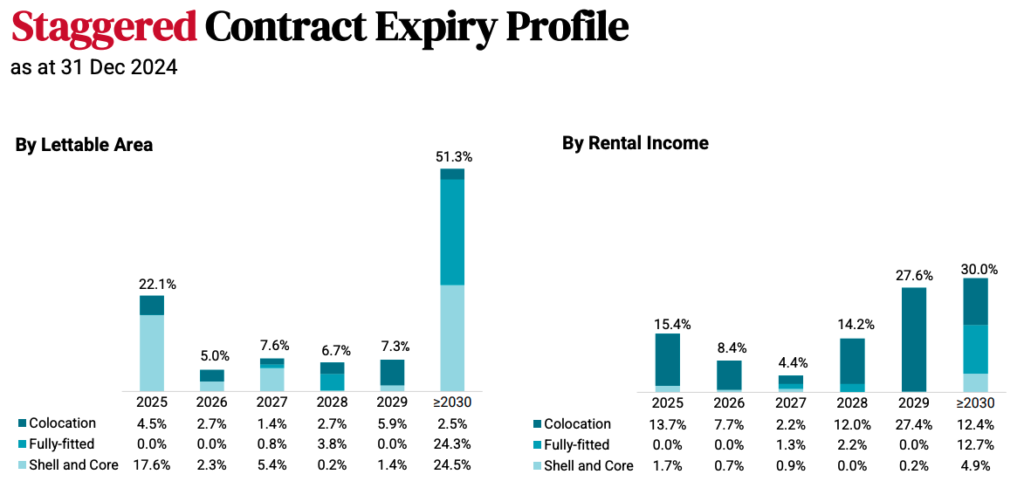

Looking at Keppel DC REIT’s portfolio, we can see that it is very resilient and stable with a strong portfolio occupancy of 97.2% (-1.1% YoY) and a long WALE of 7.6 (-1 YoY) years. The portfolio is very diversified across different contract types with a well-spread expiry profile. Based on rental income, we can see that 15.4% are expiring in 2025 and 8.4% are expiring in 2026, which means a little under 24% of the leases are expiring over the next 24 months.

5. Growth Potential

As KDC recently made its maiden acquisition in Japan, could there be more opportunities for similar acquisitions moving forward? Let’s take a look at possible growth opportunities for Keppel DC REIT.

Acquisition Opportunities from Sponsor

Keppel DC REIT is fortunate to have a large sponsor (Keppel) which has over S$2B in potential DC assets for acquisition. These DC assets are currently under Keppel as well as Keppel’s private DC funds, and span across a few key countries such as Singapore, Australia, China, Indonesia, and The Netherlands.

KDC’s maiden acquisition into the China market was in 1H 2021, right after releasing its 1H 2021 results. The strategic acquisition of Guangdong Data Centre in Jiangmen, Guangdong Province, proves to be a fantastic acquisition with a triple net lease for 15 years and the acquisition price representing a 7.8% discount to the independent market valuation. Despite the ongoing issues with the tenant in Guangdong DC, given the right circumstances, I believe KDC can venture deeper into the China market should suitable opportunities arise.

Final Thoughts

Keppel DC REIT has bounced back strong after a lackluster set of results in FY2023. As the interest rate environment continues to improve, most REITs should be at the forefront of enjoying big gains. Investors who took part in the recent EFR should be very pleased with this set of results as KDC is ending FY2024 strong and starting FY2025 even stronger. Upon market opening, we can see that the market has already forecasted similar results as KDC’s share price held relatively flat. At its opening price of S$2.22, the TTM yield stands at 4.26% which is relatively attractive, and a PB ratio of 1.45x which is quite reasonable as well.

Pingback: DeepSeek AI and Market Timing – Making Cents