Frasers Centrepoint Trust (SGX: J69U) has been badly hit by the pandemic over the past year similar to all the other retail REITs in Singapore. As such, investors are expecting a beautiful post-pandemic recovery as retail demand starts to recover. Let’s take a quick look at the 4 important takeaways from Frasers Centrepoint Trust 1H2021’s results and see if they managed to meet investors’ expectations.

1. Strong Recovery In Gross Revenue and NPI

| Year on Year Difference | FY2021 | FY2020 |

|---|---|---|

| Gross Revenue | S$341.15 million (+107.5%) | S$164.38 million |

| Net Property Income (NPI) | S$246.57 million (+122.4%) | S$110.89 million |

With retail REITs being hit the hardest last year due to the pandemic, the base was set pretty low and as such, the huge recovery in terms of Gross Revenue and NPI. If we were to compare it to 1H2019 (pre-pandemic), we can see that FCT grew its Gross Revenue and NPI by a large margin as well, from $99.014m and $71.831m, representing a growth of 75.3% and 74.9% respectively.

Although the numbers look good, It is good to note that this comparison is not very meaningful because FCT was a lot smaller back then with only 6 properties to its name as compared to now with 10 properties.

All in all, this is definitely a good sign that the retail REITs are recovering well with the economy and we can expect an even better 2H2021 with the full contribution from the newly acquired ARF assets.

2. Phenomenal Recovery In Distributable Income and DPU

| Year on Year Difference | FY2021 | FY2020 |

|---|---|---|

| Distributable Income | S$204.67 million (+102.4%) | S$101.15 million |

| Distribution Per Unit (DPU) | 12.085 cents (+33.7%) | 9.042 cents |

Similarly, because of the low base set from last year, the Distributable Income grew by 42.3% while the DPU grew by 28.4%. The table above shows 2 sets of DPUs because the upcoming distribution for shareholders is only 5.864 cents instead of the reported 5.996 cents. This is because the missing 0.132 cents were accrued prior to the new FCT units being issued and has already been paid out to shareholders on 4th December.

With the new ARF assets only contributing to 5 months worth instead of 6 full months, we can expect a much stronger recovery in 2H2021 with potential growth in DPU not only year on year but half on half as well.

3. Solid and Stable Financials

| As at 30 September 2021 | As at 31 March 2021 | |

|---|---|---|

| Aggregate Leverage | 33.3% | 35.2% |

| Interest Coverage | 5.11x | 5.04x |

| Average Cost of Debt | 2.2% | 2.2% |

Although it has been a rough year for FCT, they managed to maintain their aggregate leverage at a comfortable range post-arf acquisition at around 35.2%, a slight increase from last year’s 34.7%. They also maintained a relatively high-interest coverage ratio of 5.04x. The most important factor is the fact that they managed to drop their average cost of debt from 2.5% to a low 2.16%.

Just to put it into perspective, FCT’s total debt outstanding stands at S$2,015.6 million. This means that for every 0.01% drop in the cost of debt, FCT saves an approximate S$0.2 million. With the cost of debt dropping from 2.5% to 2.16%, this represents a drop of 0.34% or an estimated savings of S$6.853 million or 0.403 cents in terms of DPU.

4. Overview on Portfolio Stability

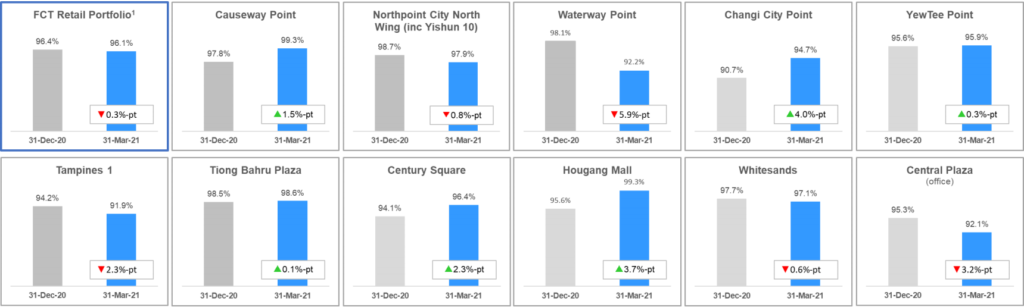

Last but not least, taking a deep dive into FCT’s overall portfolio, the occupancy rate fell by 0.3% to 96.1%. Looking at the individual assets, we can see that the occupancy rate improved across some of the assets like Causeway Point, Changi City Point, YewTee Point, Tiong Bahru Plaza, Century Square as well as Hougang Mall. Amongst the assets that saw a drop in occupancy rates, only Waterway Point and Central Plaza (Office) saw the biggest drop of 5.8% and 3.2% respectively.

Moving onto the leases across each asset, we can see that half of the assets actually saw positive YTD rental reversion. The key dips were from Changi City Point (-10.5%), Century Square (-5.7%) as well as Hougang Mall (-4.9%), and Tiong Bahru Plaza (-4.4%). The only meaningful asset that dipped was Changi City Point because the number of renewals/new leases (30) made up to 19% of the entire mall whereas the others only had a small percentage of the mall (< 5%) with negative YTD rental reversion.

Final Thoughts

Overall, we can see from Frasers Centrepoint Trust 1H2021 results that the retail sector has started its strong recovery and there is definitely more upside to come as we move into 2H2021. The slight setbacks in terms of negative YTD rental reversion, as well as portfolio occupancy, are definitely inevitable and the management has done a great job keeping it to a minimum.

Moving into 2H2021, we can expect to see stronger growth in DPU yoy, representing a huge increase in forward annualized yield for FCT. I am definitely expecting a forward annualized yield of 5% and upwards based on my cost price of $2.425.