CDL Hospitality Trust (SGX: J85), a hospitality REIT that has been beaten down by the COVID-19 pandemic, has just released its Q3 results. As the economy recovers and moves into a post-pandemic, could hospitality REITs be a good investment to take advantage of this recovery? In this article, we will deep dive into the Q3 Results of CDL Hospitality Trust and determine if it’s a good investment.

1. Continued Growth in NPI and RevPAR

Coming out of the COVID-19 pandemic, CDL Hospitality Trust continues to strong recovery with its NPI improving 23.3% year to date. We can also see that there is consistent growth quarterly in comparison to the year prior.

We can also see that the Revenue Per Available Room (RevPAR) improved significantly year over year with Japan and Italy being key growth drivers. When comparing YTD performance, we can see that Maldives is the only laggard, with a 1.1% decrease year over year.

We can see that in comparison with pre-pandemic (2019) numbers, CDL Hospitality Trust’s Japan assets have recovered significantly and outperformed.

Similarly, CDL Hospitality Trust’s Italy assets has recovered aggressively and outpaced 2019 numbers.

2. Weakening Financials

| As at 30 Sep 2023 | As at 31 Dec 2022 | |

|---|---|---|

| Aggregate Leverage | 38.4% | 36.6% |

| Interest Coverage | 2.9x | 3.7x |

| Average Cost of Debt | 4.2% | 3.5% |

Looking at CDL Hospitality Trust’s balance sheet, we can see that its aggregate leverage has increased over the past 9 months by 1.8% to 38.4% which is relatively high but still manageable if they do not foresee any acquisitions in the near term. The interest coverage ratio has also fallen to only 2.9x. The average cost of debt has also increased significantly to 4.2%.

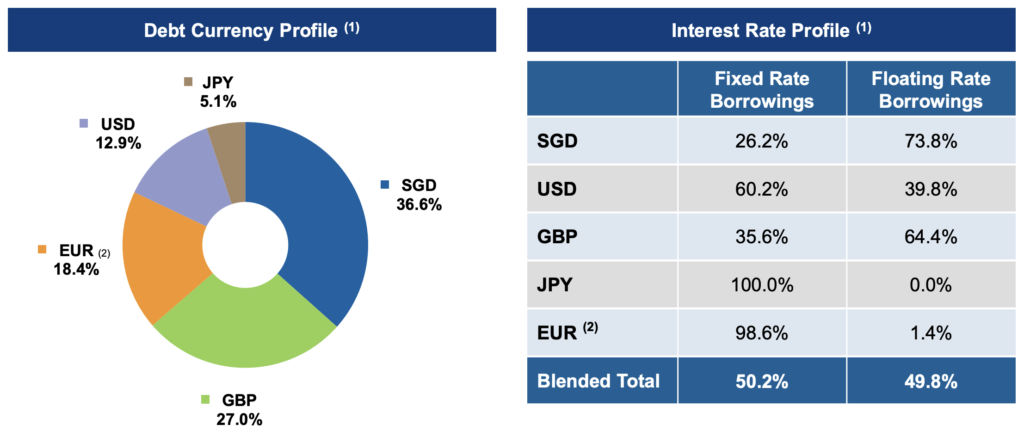

The main driver for the increase in the average cost of debt is CDL Hospitality Trust’s questionable debt management strategy. They have a blended fixed interest rate allocation of only 50.2% which is far too low, allowing the rise in interest rates to impact their overall balance sheet. Not forgetting the fact that for each 1% change in interest rates, the DPU is impacted by ~0.87 cents. In 2024, CDL Hospitality Trust will see ~S$ 383m (33.3%) of its debt maturing, of which most are fixed-term loans spread across various currencies. Hopefully, when they renew next year, rates will start to cut, allowing them to lower the average cost of debt.

3. Growth Potential

Asset Enhancement Initiatives (AEIs)

Historically, CDL Hospitality Trust has strongly favored doing continuous Asset Enhancement Initiatives (AEIs) to help rejuvenate and improve the value of its assets over mass acquisitions to grow its portfolio. We can see that over the years, even during the COVID-19 pandemic, CDL Hospitality Trust continued to grow and improve its assets.

Currently, CDL Hospitality Trust does have a few AEIs in the works such as rejuvenating W Singapore – Sentosa Cove which has been completed in Q3 2023 as well as Grand Millennium Auckland which is due to complete by November 2023.

Strong Sponsors

Another potential upside for CDL Hospitality Trust is from acquiring assets from its sponsors, Millennium & Copthorne Hotels Limited (“M&C”) and City Developments Limited. Both sponsors are very well known with plenty of high-quality assets which could be bought over by CDL Hospitality Trust. Currently, it is unknown how many right of first refusal (ROFR) assets CDL Hospitality Trust has from its 2 sponsors.

Final Thoughts

The Q3 Results of CDL Hospitality Trust have definitely shown investors a promising recovery for the REIT post-pandemic with most of its assets improving RevPAR way past pre-pandemic numbers. The main issue is the alarming balance sheet which is weakening over time. If CDL Hospitality Trust can find a way to pare down its debt and lower its average cost of debt over FY2024, I think it has strong potential to rebound back to pre-pandemic highs. At its last close of S$1.02, it has a P/B ratio of 0.723x and a TTM yield of 6.22%. This makes CDL Hospitality Trust relatively undervalued with strong potential to recover if things improve over time.