When looking for growth companies to invest in, we should look for cash rich companies with strong cash flows. What determines a cash rich growth company? Well to me, a cash rich growth company must fulfill 4 things !

- Current Assets > Total Liabilities

- Current Ratio > 1.5

- Healthy Free Cash Flow

- High ROE and ROA

In this article, I’ll go through 2 cash rich companies with strong growth potential that are trading at discount valuations currently.

PropNex Limited (SGX:OYY)

PropNex Limited is Singapore’s largest listed real estate group. Their income comes from 4 different business segments, Real Estate Brokerage Services, Training Services, Property Management Services and Real Estate Consultancy Services.

They have a huge market share in Singapore’s Real Estate market, accounting for 48% of private residential properties (New Launch), 45% of private residential properties (Resale) and 51.2% of HDB properties (Resale) in FY2019.

PropNex has shown strong growth potential, growing their revenue and gross profit year on year, with an exception in FY2019, with a slight drop as compared to the FY2018.

Also, we can see from their statement of cash flow that the company is generating a healthy amount of free cash flow.

Financial Ratios

Current Ratio : 1.83

Quick Ratio : 1.03

Current Asset to Total Liability Ratio : 1.76

Price/Earnings Ratio : 9.96 (Share Price @ $0.54)

Return on Equity : 29.37%

Return on Asset : 16.61%

Dividend Yield : 6.48% (Assuming $0.035/share)

I believe that PropNex has a strong and diversified stream of income that can help them tide through tough times. They are also generating an increasing amount of free cash flow year on year. It is also good to note that the property sector will be one of the main beneficiaries of the post-covid recovery wave.

The Hour Glass Limited (SGX:AGS)

The Hour Glass Limited is one of the world’s leading specialty luxury watch retail groups with an established presence of 40 boutiques in 11 key cities in the Asia Pacific region. You might have seen some of their stores in Singapore at malls such as VivoCity and ION Orchard.

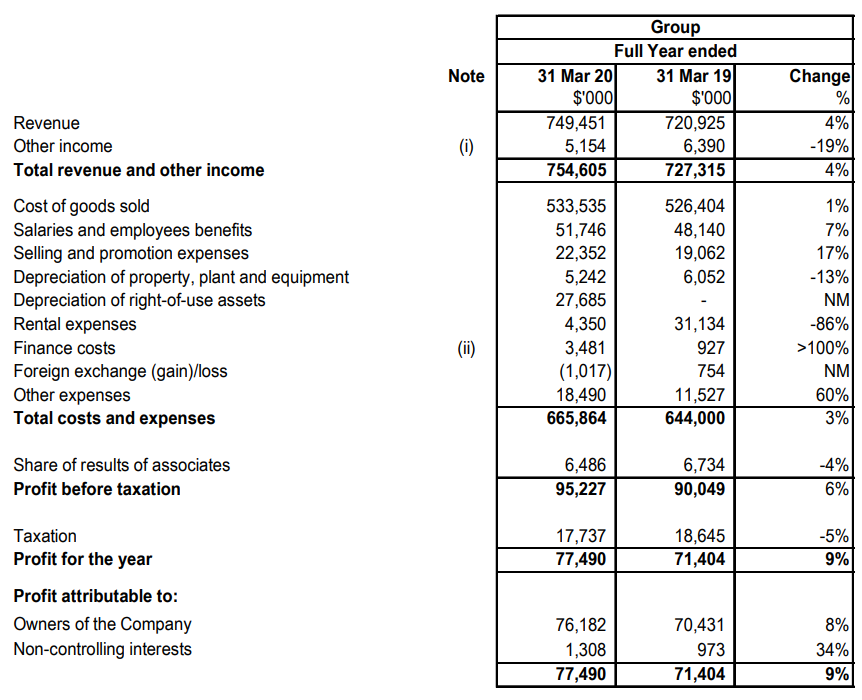

We can see that The Hour Glass has managed to increase their profits year on year even though their business has been affected by the pandemic. They are in the retail industry which has been badly affected and most stores are forced to close. It is also good to note that this increase in income is mainly contributed by the 4% increase in revenue and the 86% decrease in rental expenses.

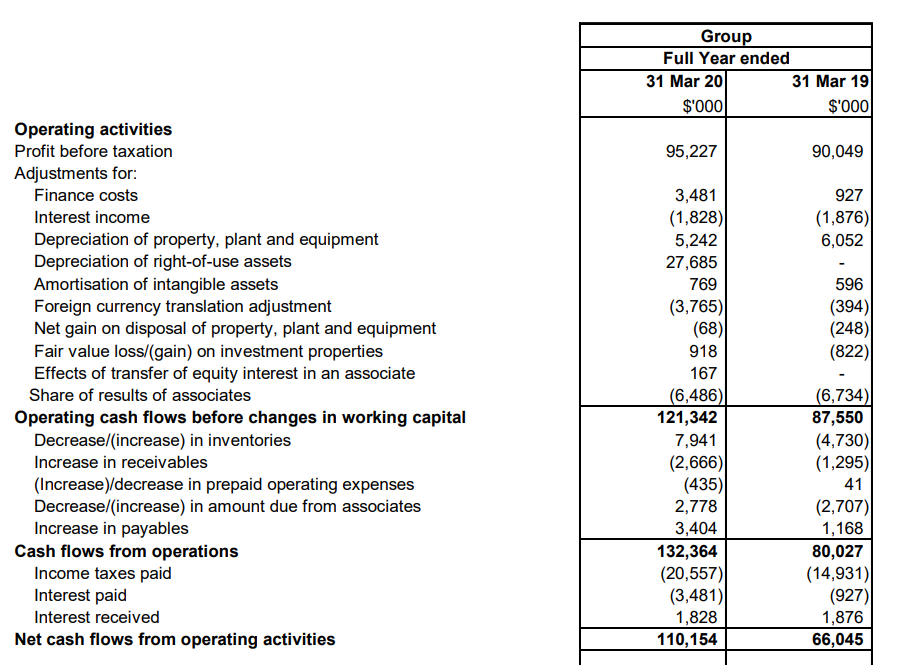

Similar to PropNex, we can see from The Hour Glass’s statement of cash flow, the company is generating a healthy amount of free cash flow. It is also good to note that the company managed to almost double its net cash flow from operating activities year on year. That’s impressive !

Financial Ratios

Current Ratio : 3.24

Quick Ratio : 3.10

Current Asset to Total Liability Ratio : 2.10

Price/Earnings Ratio : 6.11 (Share Price @ $0.66)

Price/Book Ratio : 0.77 (Share Price @ $0.66)

Return on Equity : 12.44%

Return on Asset : 11.12%

Dividend Yield : 4.55% (Assuming $0.03/share)

I believe that The Hour Glass has a strong balance sheet to tide through this tough time. They are also generating an increasing amount of free cash flow year on year. It is also good to note that the retail sector will also be one of the main beneficiaries of the post-covid recovery wave.

Final Thoughts

Looking at the two companies, we can see that there are some overlapping factors between the two. Besides the fact that both of them fulfill the 4 factors that I use to determines a cash rich growth company, both companies can stand to benefit greatly from the post-covid recovery.

The great thing about investing in cash rich growth companies is that their growth is justifiable through their strong cash flows rather than the company/industry being hyped up by investors. You can also sleep peaceful at night knowing that the company can pay off all their liabilities easily.